DTB Tanzania

This banking software acts as a virtual relationship manager to guide potential customers about the products and services that banks offer. It provides all the information to the customers that they may need, such as types of accounts, loan or credit requirements, and the cards that the banks offer. This way, it reduces the burden on employees to answer customer queries through automated conversations. It can also collect lead data while conversing with the customers to increase the conversion rate and push the customers into the sales funnel.

Explore Finance & Banking solutionsFeatures and Benefits :

Similar Templates in Finance & Banking Industry

Invest in your customer satisfaction with Tars AI Agents

Financial Concierge AI

Financial Concierge AI offers a comprehensive package of features designed specifically for finance & banking companies.

Financial Advisor AI

Financial Advisor AI is designed to help finance & banking companies guide potential customers through tailored buyer journeys.

Finance Workflow AI

Finance Workflow AI for internal automation

Frequently Asked Questions

Trusted by 500+ Global Brands

Ready for higher conversion rates?

Book a slot with a Tars expert to see how chatbots can increase your conversion rate by 50%

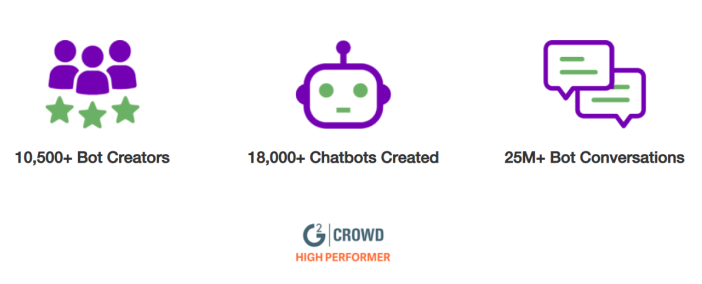

Tars is rated #1 in the Chatbot Platform Category

Manager of IT Services

Real Estate

Real Estate

IT Services

50M - 250M USD

The TARS team was extremely responsive and the level of support went beyond our expectations. Overall our experience has been fantastic and I would recommend their services to others.

Lindsey Roark Mayes

Ex-Director of SOS IT (State of Indiana)

Government

Implementing a chatbot revolutionized our customer service channels and our service to Indiana business owners. We're saving an average of 4,000+ calls a month and can now provide 24x7x365 customer service along with our business services.

Marketing Operations Manager

Healthcare and Biotech

Healthcare and Biotech

Marketing

30B + USD

The Tars team has been wonderful to work with. We've used them for a few years and just expanded their tools' use; the customer support they offered was unmatched. I appreciate everything they have assisted us with. The platform itself is very user-friendly and straightforward to navigate. It had all the features we needed; if not, they added it.

Levi Eastwood

Marketing Director, UCI Paul Merage School of Business

Education

Since our launch of Tars chatbots, we've had more than 5k interactions with them from individuals on the website. We saw prospects interacting with the chatbot regarding application timelines, tuition, curriculum, and other items that may come through an email. This provides another avenue of access to our team while cutting down on staff needing to email back.

Product Manager

Finance (non-banking)

Finance

Product Management

50M - 250M USD

My organization is using Tars Chatbot more than 2 years now. The Chatbot is very useful is generating quality leads for us.