Enabling intelligent customer interactions and efficient operations

Financial Concierge AI offers a comprehensive package of features designed specifically for finance & banking companies.

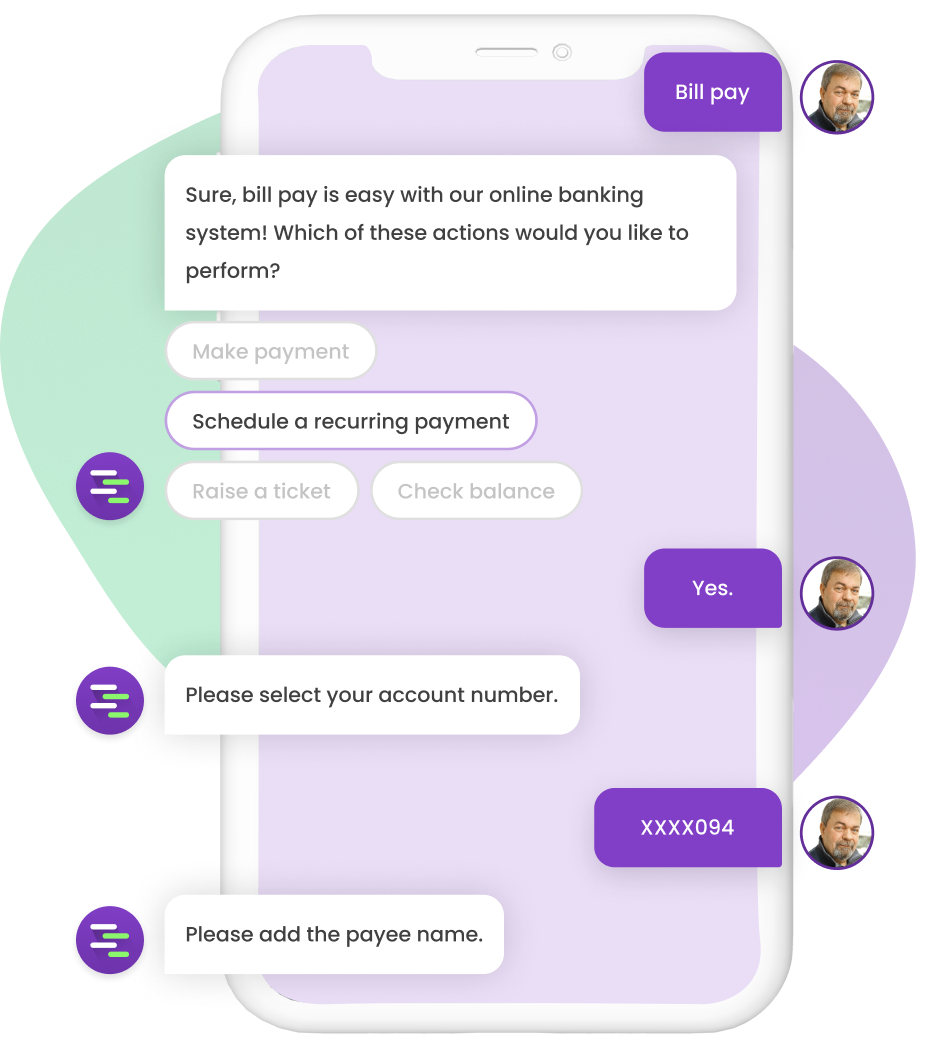

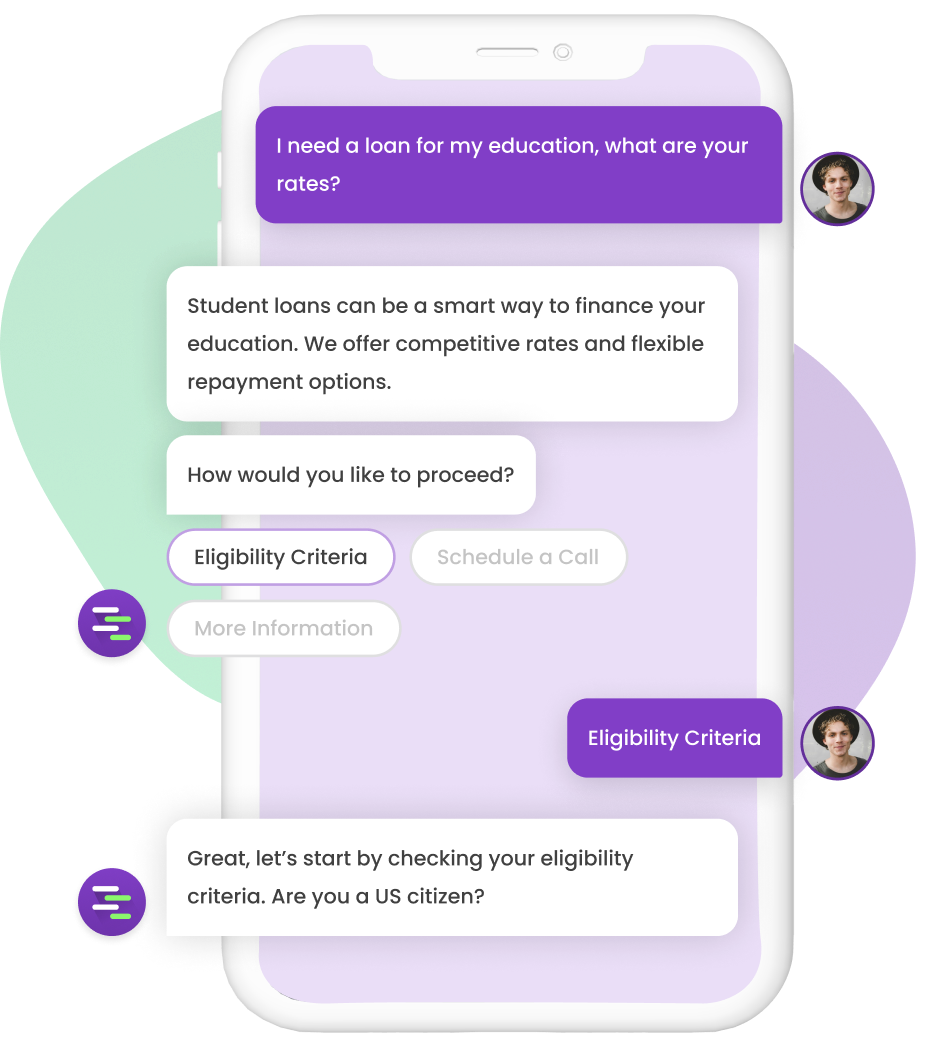

Streamlined account management

Automate financial processes like account opening, loans, and credit cards to ensure compliance, reduce errors, and boost efficiency and satisfaction.

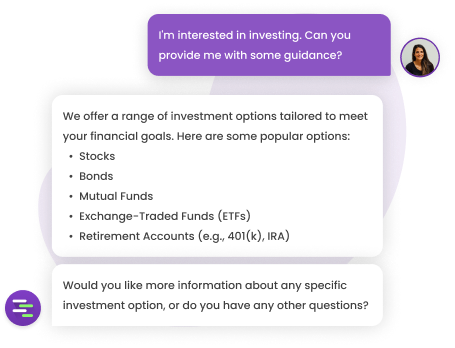

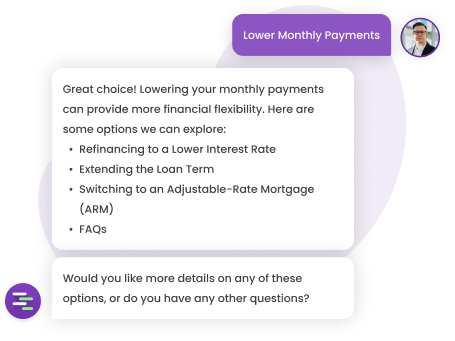

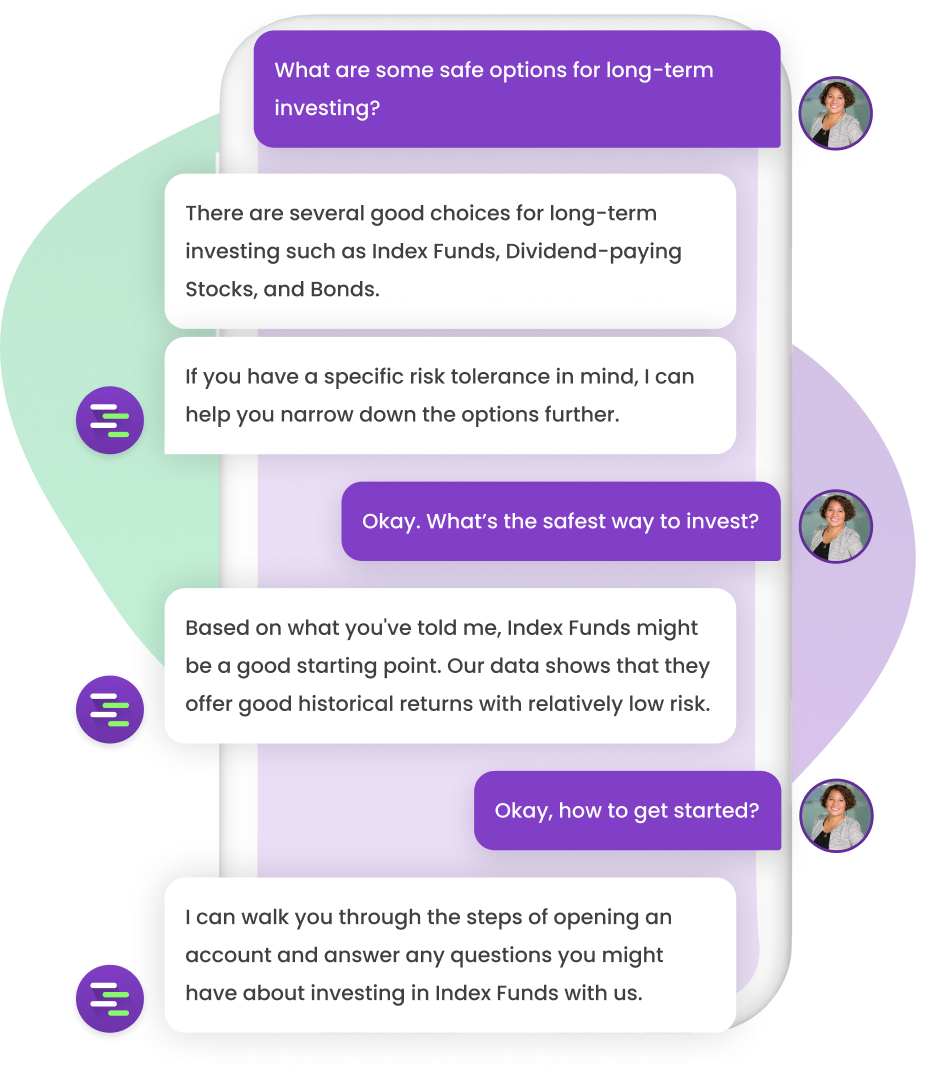

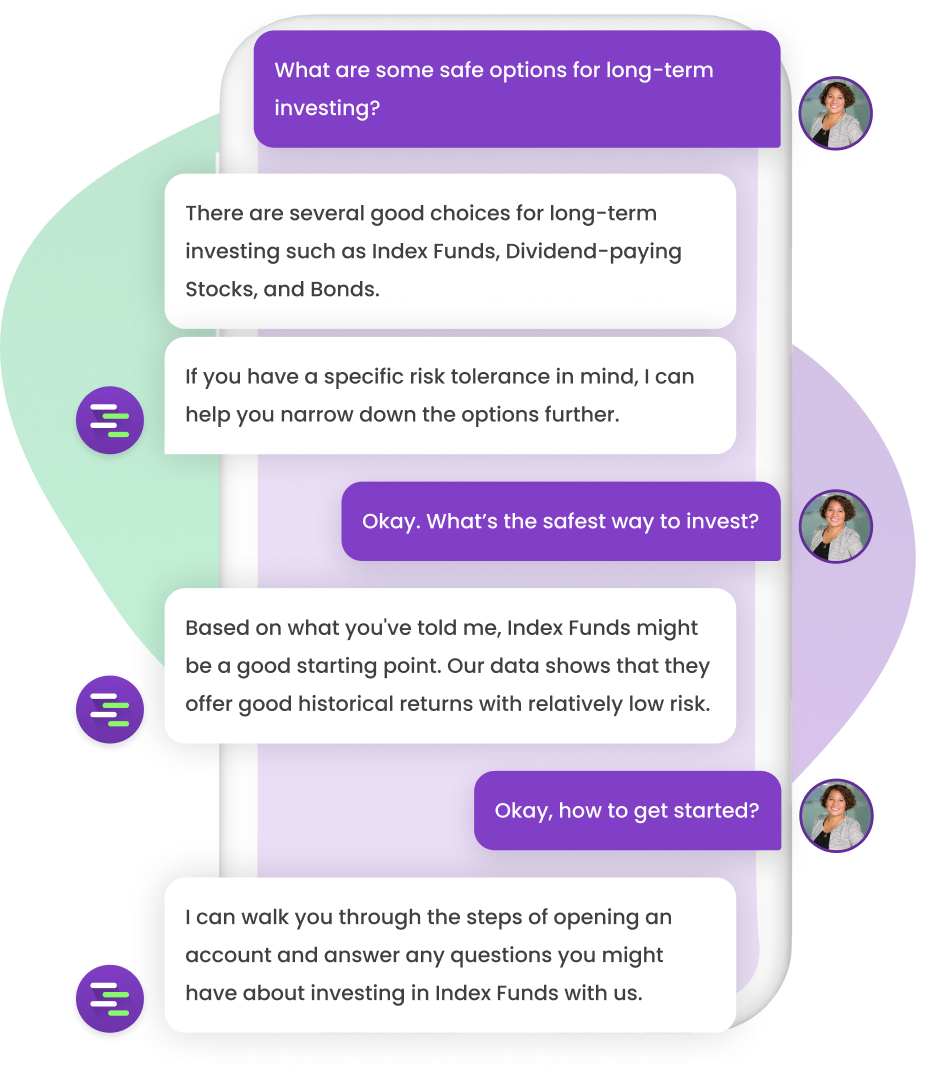

Instant financial guidance

Provide accurate, instant answers about financial products, features, rates, and fees, reducing staff workload and enabling informed customer decisions.

Seamless system integration

Integrate with banking systems, credit card software, and CRMs to automate account updates, payments, and risk assessment, boosting efficiency.

Omnichannel customer engagement

Engage customers on WhatsApp, SMS, App, and Web for easier account management, inquiries, and support, boosting satisfaction and loyalty.

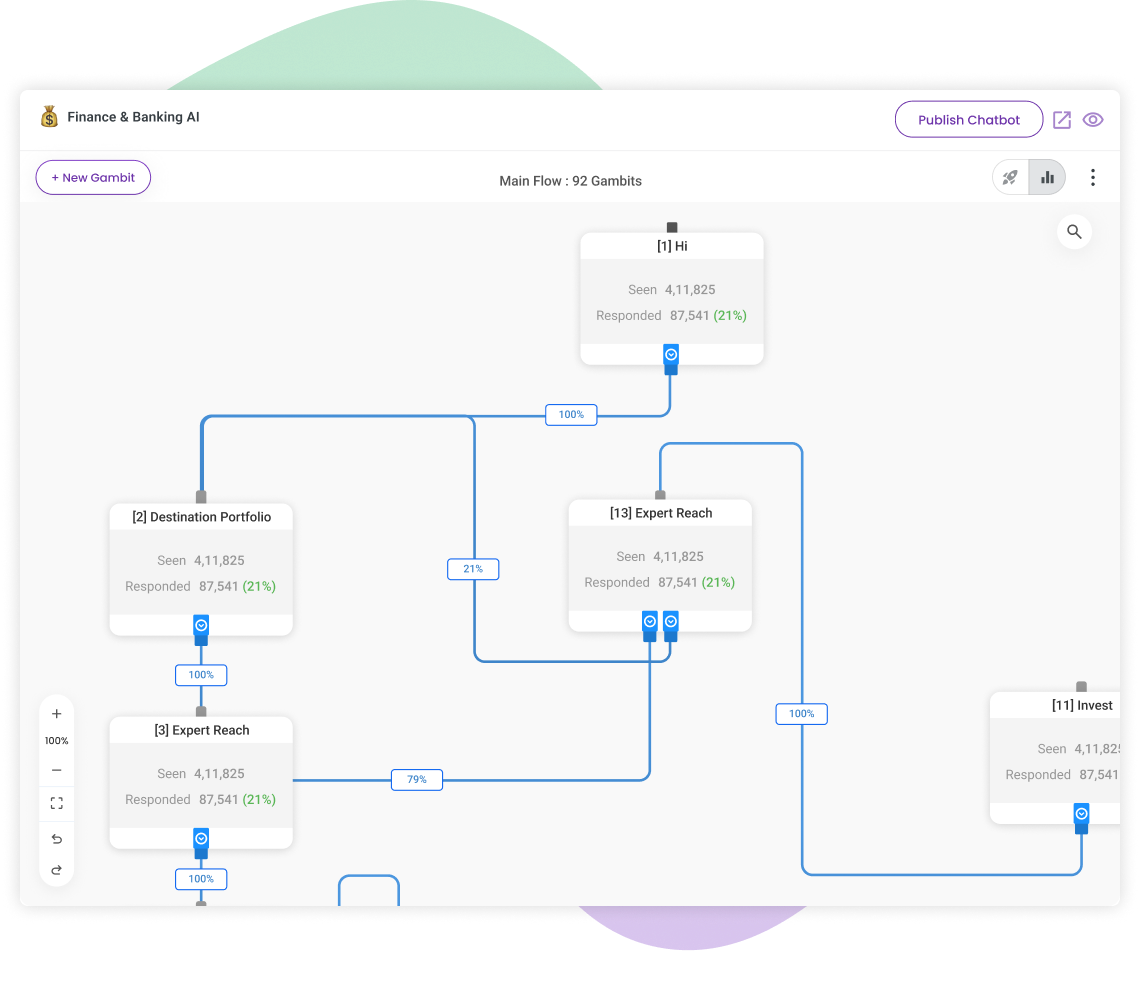

Customer behavior insights

Analyze customer interactions to identify pain points and improve financial processes, optimizing experience, reducing churn, and increasing adoption and revenue.

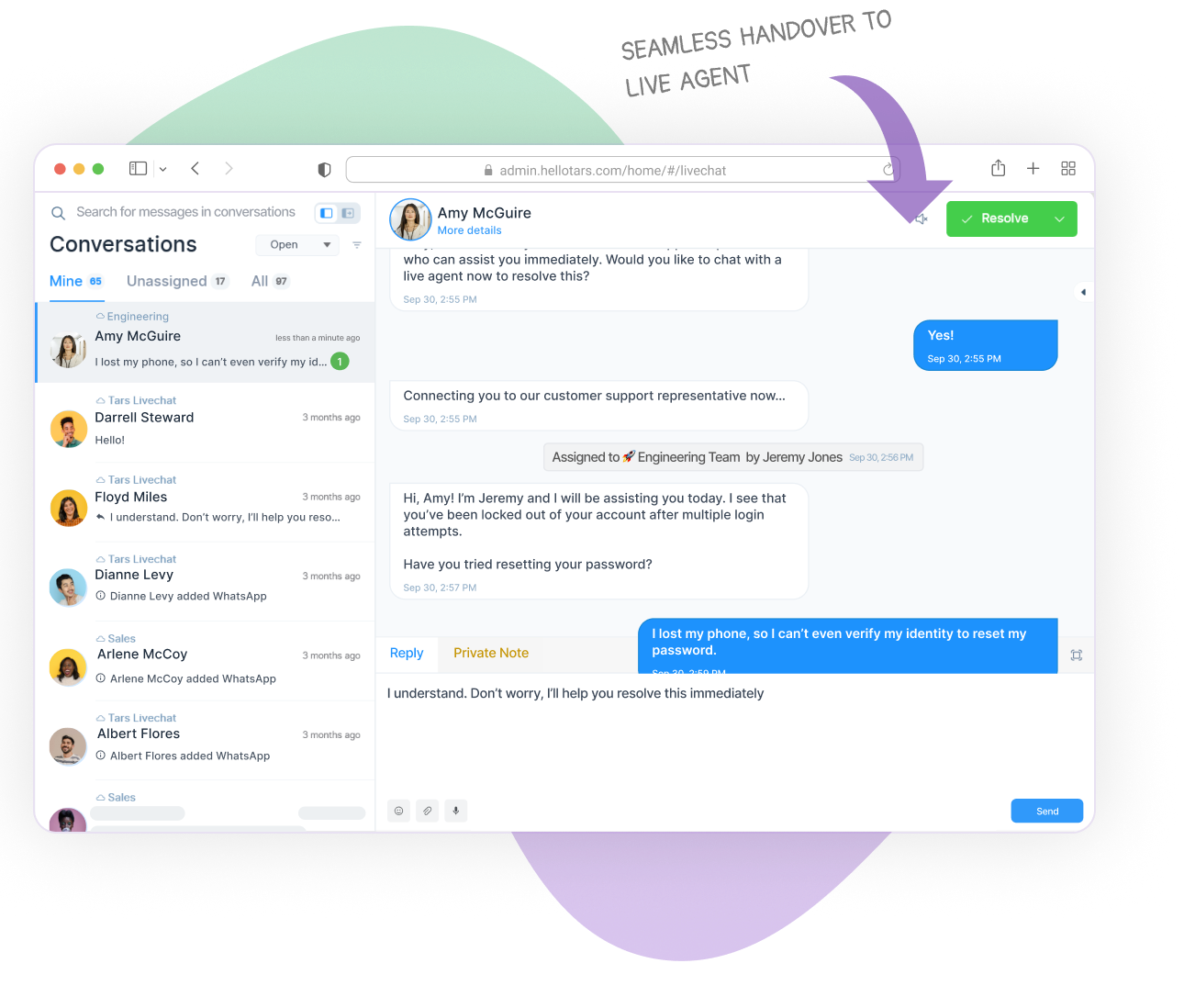

Seamless human-AI collaboration

Seamlessly blend AI efficiency with human expertise via live chat when needed, ensuring personalized support and optimal customer experience.

Explore Financial Concierge AI use cases

Frictionless account opening and setup

Equip your clients with educational support and personalized guidance while automating and streamlining onboarding processes.

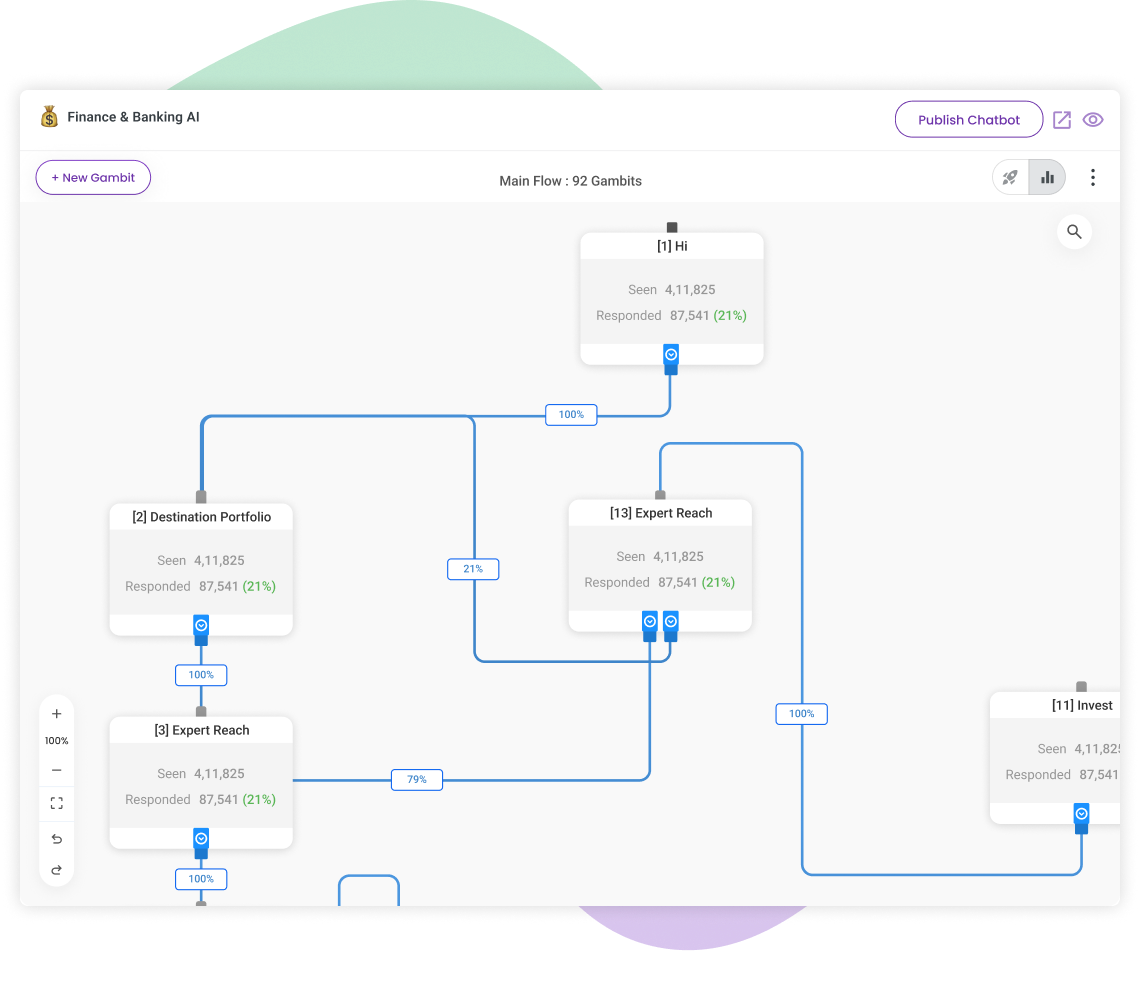

Improve the financial experience with actionable insights

With Tars’ advanced analytics to pinpoint moments of delight and potential drop-off points, gain deeper insights into your clients’ behavior even when they don’t interact with you.

Frictionless account opening and setup

Equip your clients with educational support and personalized guidance while automating and streamlining onboarding processes.

Improve the financial experience with actionable insights

With Tars’ advanced analytics to pinpoint moments of delight and potential drop-off points, gain deeper insights into your clients’ behavior even when they don’t interact with you.