Purpose-built AI automation for financial services

Customer Support

Smart support for every customer

Build compliance-ready Agents without engineering

- Configure AI Agents that handle sensitive inquiries around account reconciliation, debit adjustments, and regulatory disclosures using Tars' visual builder.

- Connect your Knowledge Base, BSA/AML policies, and core banking systems through 600+ pre-built integrations, including loan origination software, digital banking platforms, and wealth management CRMs.

- Deploy Agents that understand CD rates, ACH transfers, and overdraft protection, without writing code or waiting on development sprints.

.png)

Test Agent accuracy before customers see a single response

- Generate synthetic test datasets that evaluate how your Agent handles deposit account inquiries, chargeback disputes, and mortgage servicing requests.

- Validate retrieval accuracy across Truth in Lending Act disclosures, Regulation E claims, and APR calculations.

- Test tool selection for multi-step processes and ensure compliance and response quality before any member interaction goes live.

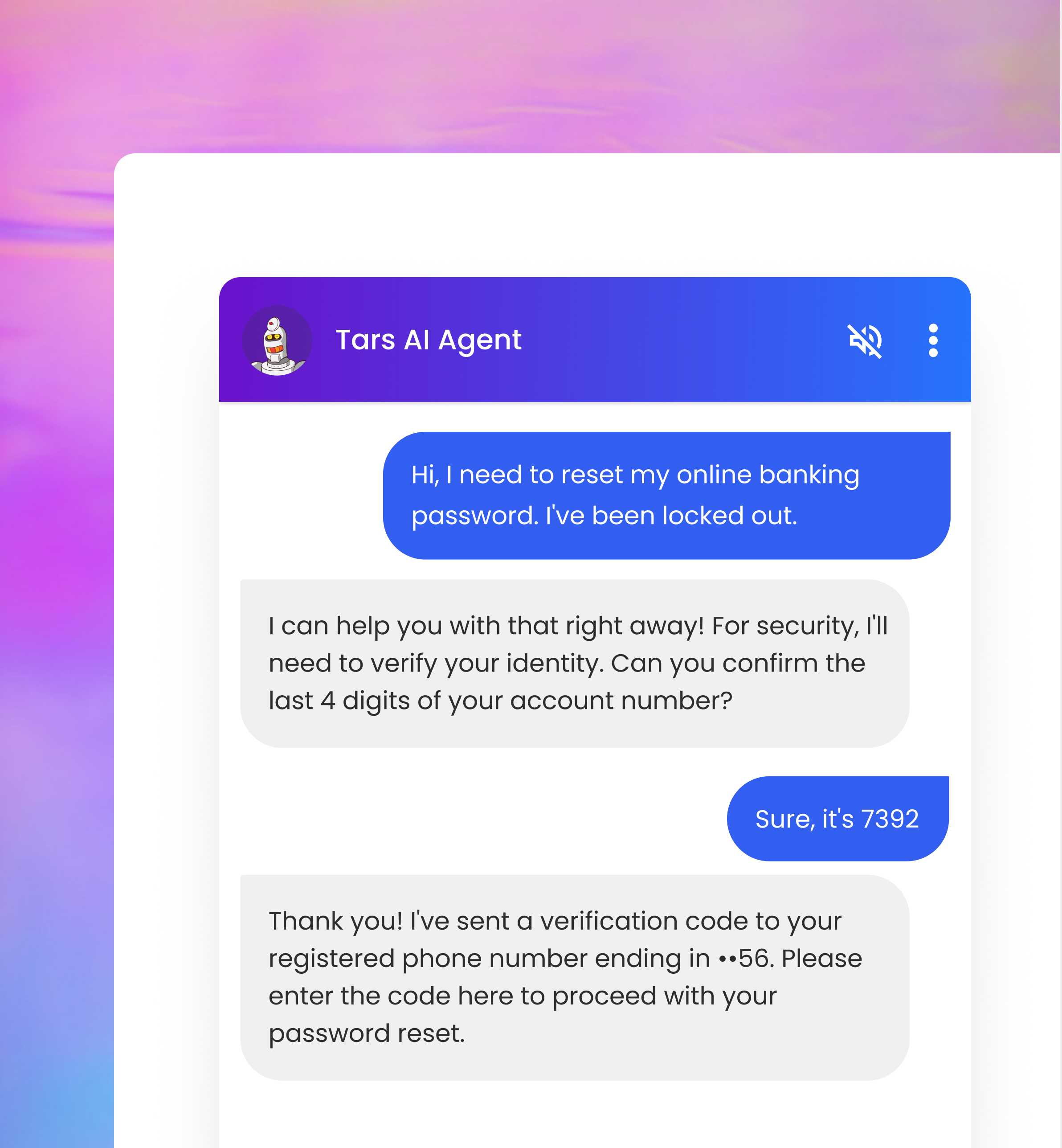

Deflect repetitive inquiries that drain member services’ capacity

- Automate the high-volume queries that overwhelm your contact center, online banking password resets, check clearing status, direct deposit setup, statement requests, NSF fee explanations, and routing number lookups.

- Tars Agents resolve these requests instantly while routing complex cases like unauthorized transaction claims, loan modification requests, or estate account inquiries to relationship managers.

- Reduce call center volume by up to 45% and let your team focus on deposit growth and loan portfolio management.

Monitor resolution rates and CSAT across every member conversation

- Track more than basic metrics with analytics built for financial services operations. Review full conversation transcripts to identify friction points in card dispute resolution or mortgage servicing.

- Measure first-call resolution rates, Net Promoter Score trends, and adherence to TCPA, FDCPA, and fair lending guidelines.

- Use these insights to refine Agent responses for rate inquiries, update disclosure language, and improve member satisfaction scores.

.png)

Customer Acquisition

Convert more prospects, faster

Pre-qualify borrowers before they reach your loan officers

- Deploy Agents that conduct preliminary credit assessments for home equity lines, auto loans, personal loans, and small business credit.

- Collect debt-to-income ratios, employment verification, credit score ranges, and collateral details through natural conversation flows.

- Calculate monthly payments using current APRs, present amortization schedules, and capture contact details for qualified applicants.

- Filter out subprime borrowers automatically so your lending team focuses on high-LTV opportunities and faster closings.

Guide accountholders through cross-sell opportunities

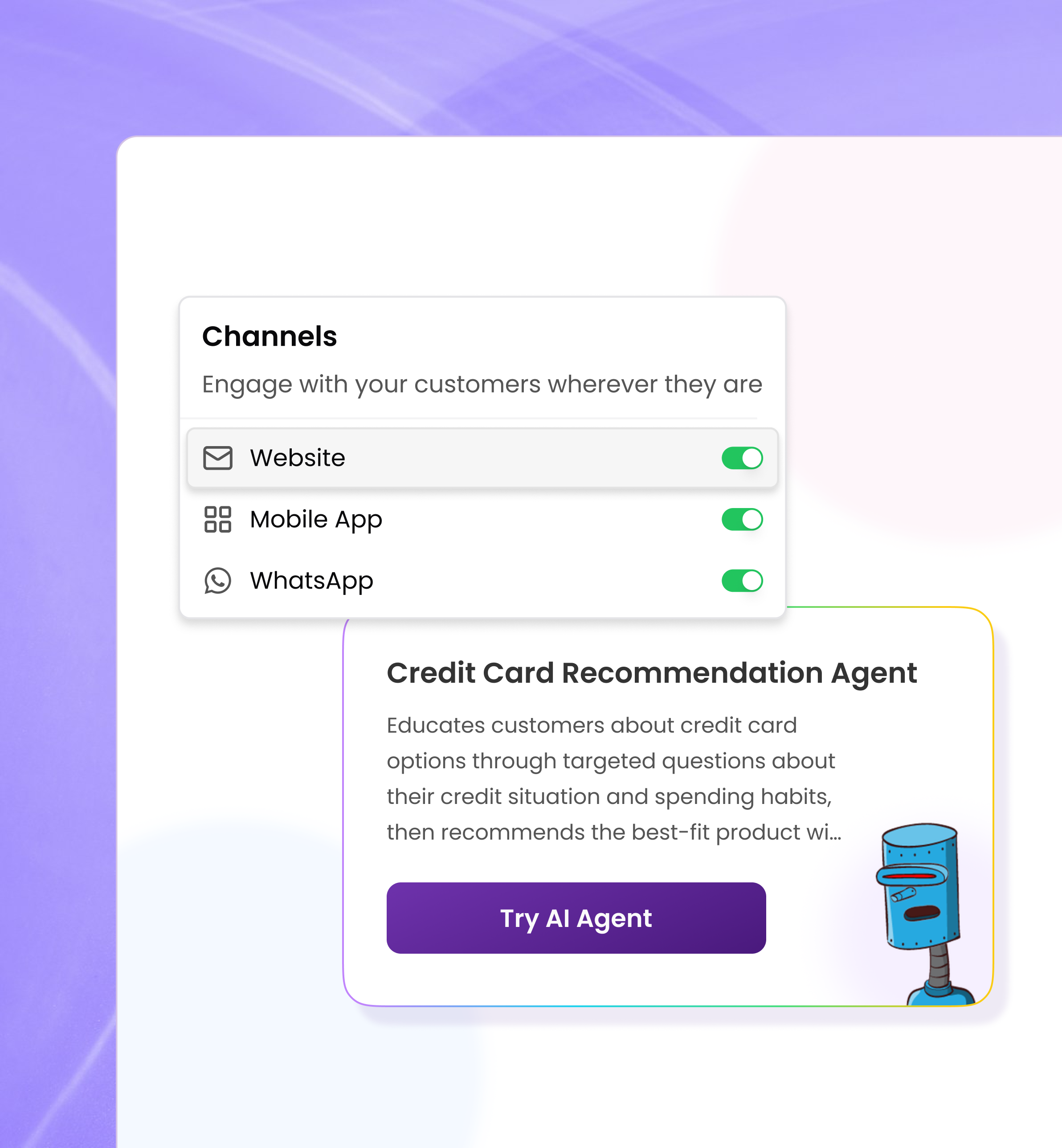

- Run targeted campaigns for existing depositors using Agents embedded across channels.

- Present personalized recommendations for premium checking accounts, IRA rollovers, certificates of deposit, or credit card balance transfers based on average daily balance and relationship tenure.

- Explain tiered interest structures and capture new account applications, all within the same conversation.

Deploy across channels in hours, not months

- Once your Agent passes testing benchmarks, launch it across multiple channels without lengthy implementation cycles.

- Tars handles the technical integration with your digital banking stack while you control the rollout schedule.

- Scale from pilot branches to enterprise-wide deployment in days, whether you're serving 10,000 credit union members or managing assets under administration for millions of retail banking customers.

Collect verified contact details and route qualified leads to relationship managers

- Capture lead information through conversational account opening flows that feel consultative, not transactional.

- Validate Social Security numbers, verify phone numbers against OFAC lists, and confirm mailing addresses in real-time.

- Route qualified prospects to the right wealth advisor, mortgage banker, or business banking officer based on product interest, loan amount, or branch territory.

- Integrate directly with your CRM or loan origination system so leads enter your pipeline immediately, no manual data entry or duplicate account checks required.

.png)

.png)

%201.png)

%201.png)