Car Accident Claim Chatbot

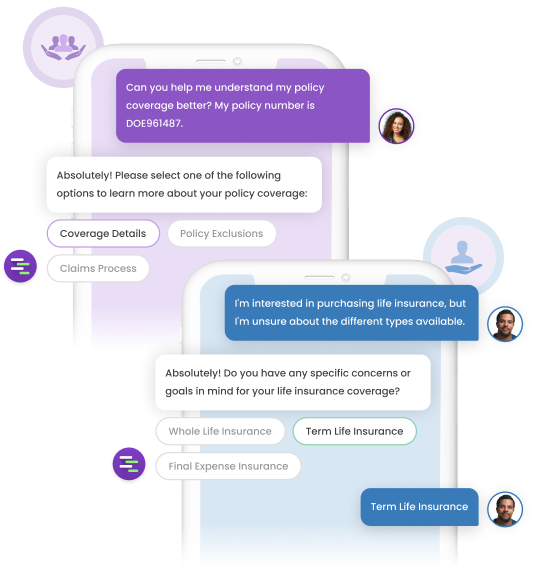

Insurance companies often find it difficult to respond to legitimate claims of their loyal policy holder. For better claims processing service, auto insurance companies can turn to this free claim automation chatbot which makes customer service interactions worthwhile, with the help of conversational intelligence.

Explore Insurance solutionsFeatures and Benefits :

Similar Templates in Insurance Industry

Insure your customer satisfaction with Tars AI Agents

Insurance Concierge AI

Insurance Concierge AI offers a comprehensive package of features designed specifically for insurance companies.

Insurance Advisor AI

Insurance Advisor AI is designed to help insurance companies guide potential customers through tailored buyer journeys.

Insurance Workflow AI

Insurance Workflow AI for internal automation

Frequently Asked Questions

Chosen by 800+ global brands across industries

Ready for higher conversion rates?

Book a slot with a Tars expert to see how chatbots can increase your conversion rate by 50%

Tars is rated #1 in the Chatbot Platform Category

Manager of IT Services

Real Estate

Real Estate

IT Services

50M - 250M USD

The TARS team was extremely responsive and the level of support went beyond our expectations. Overall our experience has been fantastic and I would recommend their services to others.

Lindsey Roark Mayes

Ex-Director of SOS IT (State of Indiana)

Government

Implementing a chatbot revolutionized our customer service channels and our service to Indiana business owners. We're saving an average of 4,000+ calls a month and can now provide 24x7x365 customer service along with our business services.

Marketing Operations Manager

Healthcare and Biotech

Healthcare and Biotech

Marketing

30B + USD

The Tars team has been wonderful to work with. We've used them for a few years and just expanded their tools' use; the customer support they offered was unmatched. I appreciate everything they have assisted us with. The platform itself is very user-friendly and straightforward to navigate. It had all the features we needed; if not, they added it.

Levi Eastwood

Marketing Director, UCI Paul Merage School of Business

Education

Since our launch of Tars chatbots, we've had more than 5k interactions with them from individuals on the website. We saw prospects interacting with the chatbot regarding application timelines, tuition, curriculum, and other items that may come through an email. This provides another avenue of access to our team while cutting down on staff needing to email back.

Product Manager

Finance (non-banking)

Finance

Product Management

50M - 250M USD

My organization is using Tars Chatbot more than 2 years now. The Chatbot is very useful is generating quality leads for us.

Book Your Personalized Demo

Believe what you can measure

Webinars

See all Webinars >>Real results, real customers, real stories

“We're saving an average of 4,000+ calls a month.”Implementing an Agent revolutionized our customer service channels and our service to Indiana business owners. We're saving an average of 4,000+ calls a month and can now provide 24x7x365 customer service️ along with our business services.Lindsey Roark MayesEx-Director of SOS IT (State of Indiana)

“Cutting down on staff needing to email back.”Since our launch of Tars Agents, we've had more than 5k interactions with them from individuals on the website. We saw prospects interacting with the Agent regarding application timelines, tuition, curriculum, and other items that may come through an email. This provides another avenue of access to our team while cutting down on staff needing to email back.Levi EastwoodMarketing Director of UCI Merage School

“Powerful tool - and there's so much more still to explore!”I love the flexibility of the TARS chatbot design tool. The ability to drop in a new gambit and easily de-link and re-link gambits before and after it saves HOURS of time lost if I had to regenerate from scratch. TARS stands out for its flexibility, consistent performance, and outstanding support.Aaron RittmasterFounder

“Very responsive and supportive Team”I love how supportive and responsive the team members are. The chatbots are not difficult to build once you have an idea of what you are doing, and this is so based on the backend work Tars has completed. Also, they are flexible to the clients' requests.Keisha CameronProduct Manager

“Easy for cooperation and open to agreement.”One of the biggest qualities of TARS is their ability to truly understand their clients' needs. They took the time to thoroughly assess our requirements, offering valuable insights and recommendations that we hadn't even considered. This level of personalized attention made a significant difference in the success of our project.Milica PetrovicCustomer Care Project Associate

“Great service”The guys at Tars are so passionate about bots and maximum engagement. Tars is overall a great product with really nice people there to help me engage and automate conversations I would have otherwise missed.Nigel GoslingHealth Coach

“Best in class for lead generation”TARS is an essential tool within our lead gen strategy. I started to use it a couple years ago, and the platform evolved to focus on results. You can integrate your Google Analytics, Facebook Pixel, and AdWords conversion tag to track results and measure your campaign. You can also integrate with Zapier, which opens a lot of possibilities. Compared with static landing pages, we have seen an increase in conversions and more engagement.Leonardo WolffFounder

“Very professional and cooperative”Building an automated chat that our customers actually used and reduced calls amount.Maryam AlhaddadCustomer Journey Designer

“Flexibility and good service”Tars platform is very flexible, so you can do pretty much any flux you desire. Also integrates with any third party through APIs with a very simple and easy-to-use interface. Also tars team is great! Always at disposal and brings suggestions and solutions for any issue encountered during the process of building the chatbot.Lucas Von LachmannProcess Manager

“I like the product.”Takes those boring forms and allows you to make the collecting of customer information enjoyable for the user. It has a lot of value and I see the company constantly working on improving it.Pierre RattiniDirector of Marketing

“Deserved The title of the Best Chatbot of the Year”If you are building chatbots, you cannot go wrong with TARS. I have been with this company since their beginning. Seen how they have grown. I have tested a lot of bots, but this one is still the best out there. We use WhatsApp a lot for our business. And what I like best is that I can have 1 chatbot for website and for my WhatsApp. I especially appreciate their support team as well. Whenever I am stuck, they quickly reply to my questions.MJ FelixChairman

“Advanced integration, easy to use, and very customizable.”This chatbot does everything from AI integration to complete customization and is excellent for lead conversion in most industries. I think the pre-formatted templates are an excellent boost to get started quickly. The team is also excellent.Rachel RowlingChief Operating Officer

“The chatbot implementation has exceeded expectations!”The implementation has delivered 24/7 customer support and is proving its value by reducing Contact center calls by around 5% in just four months of operation. Beyond enhancing the e-care experience, the chatbot is driving impressive business results, achieving a remarkable 20% month-on-month growth.Victor PereiraCustomer Care and CX Manager

“We're saving an average of 4,000+ calls a month.”Implementing an Agent revolutionized our customer service channels and our service to Indiana business owners. We're saving an average of 4,000+ calls a month and can now provide 24x7x365 customer service️ along with our business services.Lindsey Roark MayesEx-Director of SOS IT (State of Indiana)

“Cutting down on staff needing to email back.”Since our launch of Tars Agents, we've had more than 5k interactions with them from individuals on the website. We saw prospects interacting with the Agent regarding application timelines, tuition, curriculum, and other items that may come through an email. This provides another avenue of access to our team while cutting down on staff needing to email back.Levi EastwoodMarketing Director of UCI Merage School

“Powerful tool - and there's so much more still to explore!”I love the flexibility of the TARS chatbot design tool. The ability to drop in a new gambit and easily de-link and re-link gambits before and after it saves HOURS of time lost if I had to regenerate from scratch. TARS stands out for its flexibility, consistent performance, and outstanding support.Aaron RittmasterFounder

“Very responsive and supportive Team”I love how supportive and responsive the team members are. The chatbots are not difficult to build once you have an idea of what you are doing, and this is so based on the backend work Tars has completed. Also, they are flexible to the clients' requests.Keisha CameronProduct Manager

“Easy for cooperation and open to agreement.”One of the biggest qualities of TARS is their ability to truly understand their clients' needs. They took the time to thoroughly assess our requirements, offering valuable insights and recommendations that we hadn't even considered. This level of personalized attention made a significant difference in the success of our project.Milica PetrovicCustomer Care Project Associate