1. The motor insurance chatbot collects the customer's name, date of birth, nationality, vehicle make and model number, and vehicle model year.

2. It asks the following questions: for what purpose do you use this vehicle, do you remember the vehicle registration number, enter the vehicle registration location, how many years of UAE driving experience do you have, did your vehicle ever encounter a total loss, share your previous policy expiry date, what type of cover does your previous policy provide.

3. It collects the customer's email address and phone number for further contact.

4. The chatbot will ask for all the necessary information about the customer’s car from them so that they don't need to tell the same thing again and again.

5. It saves time by providing the customer with the most suitable quote within seconds.

6. It helps the customer get the best deal on their insurance policy.

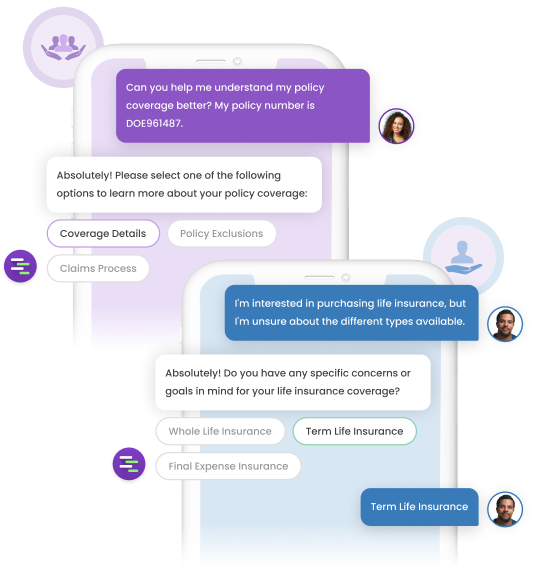

7. It can be configured to provide all the insurance products and various coverage options to prospective customers.

8. It can enhance customer interaction, and in turn, conversion rates without human intervention.

9. Financial institutions can improve agent productivity with the help of conversational AI.

10. It can reduce operational costs by resolving customer queries quickly.