Automation of Accounting Processes Using AI Chatbots

Ever wondered how much automation can transform accounting? The benefits of automation technologies like AI Chatbots include improving accounting processes, streamlining operations, and reducing costs. According to McKinsey & Company, the adoption of advanced automation and analytics in risk management can slash operational costs by 20% to 30%. It’s no wonder that business owners and finance professionals are asking, “How can I automate accounting processes using AI Chatbots?”

In this blog, we will explore:

- How accounting processes can be automated

- The benefits of automating accounting processes

- The applications and use-cases of AI Chatbots in automating accounting

- The future of AI in accounting

What is automation of accounting processes?

Automation of accounting processes refers to using technology to perform tasks that were (previously) done manually. These tasks include invoice processing, account reconciliation, and financial reporting. Automating these processes improves accuracy and efficiency while reducing errors and costs.

Types of automation in accounting processes include:

- Robotic Process Automation (RPA): RPA uses software robots to perform repetitive tasks.

- Artificial Intelligence (AI): AI involves using intelligent algorithms to handle complex tasks.

- Machine Learning (ML): ML is a subset of AI that uses data to improve task performance over time.

What are AI Chatbots and their applications in accounting?

AI Chatbots are an advanced technology that leverage the strengths of both structured Chatbots and Generative AI. They simulate conversations using Natural Language Processing (NLP), making interactions more natural with human-like responses.

In accounting, they can automate tasks and conversations, helping businesses save costs and manual labor while simultaneously increasing accuracy in accounting operations.

Although there are different types of Chatbots that can be used in accounting processes, AI Chatbots stand out because:

- Unlike structured Chatbots that follow predefined scripts, AI Chatbots are more dynamic and can handle complex queries

- AI Chatbots are scalable and require less manual labor for updates/upgrades

- They offer a greater level of personalization and can understand customer preferences

AI Chatbots can be applied in many ways, such as processing invoices or payments, automating communication with customers or vendors, and identifying or analyzing trends/patterns to help businesses make data-backed decisions.

How AI Chatbots can be used for automation of accounting processes: Use cases

AI Chatbots can be used to automate a variety of accounting processes. Let’s learn more from the lens of account management, vendor and customer management, financial reporting, and financial analysis.

1. AI Chatbots for accounts payable

- Invoice Processing: AI Chatbots can be trained to recognize invoice details (e.g. invoice number, amount, and due date) and then process the invoice automatically. Additionally, they can match invoices to purchase orders and contracts, ensuring that invoices are accurate and authorized.

- Vendor Management: AI Chatbots can help businesses manage their vendor communications, track performance metrics, and identify opportunities for cost savings. For example, AI Chatbots can send automated reminders to vendors about upcoming payments or contracts, track delivery times and quality, and help identify vendors that consistently offer lower prices or higher quality products.

- Payment Processing: AI Chatbots can automate payments to vendors and reconcile them with invoices, improving accuracy and saving time.

2. AI Chatbots for accounts receivable

- Customer Invoicing: AI Chatbots can generate and send invoices automatically. Additionally, AI Chatbots can track invoice status and send automated reminders to customers about upcoming payments.

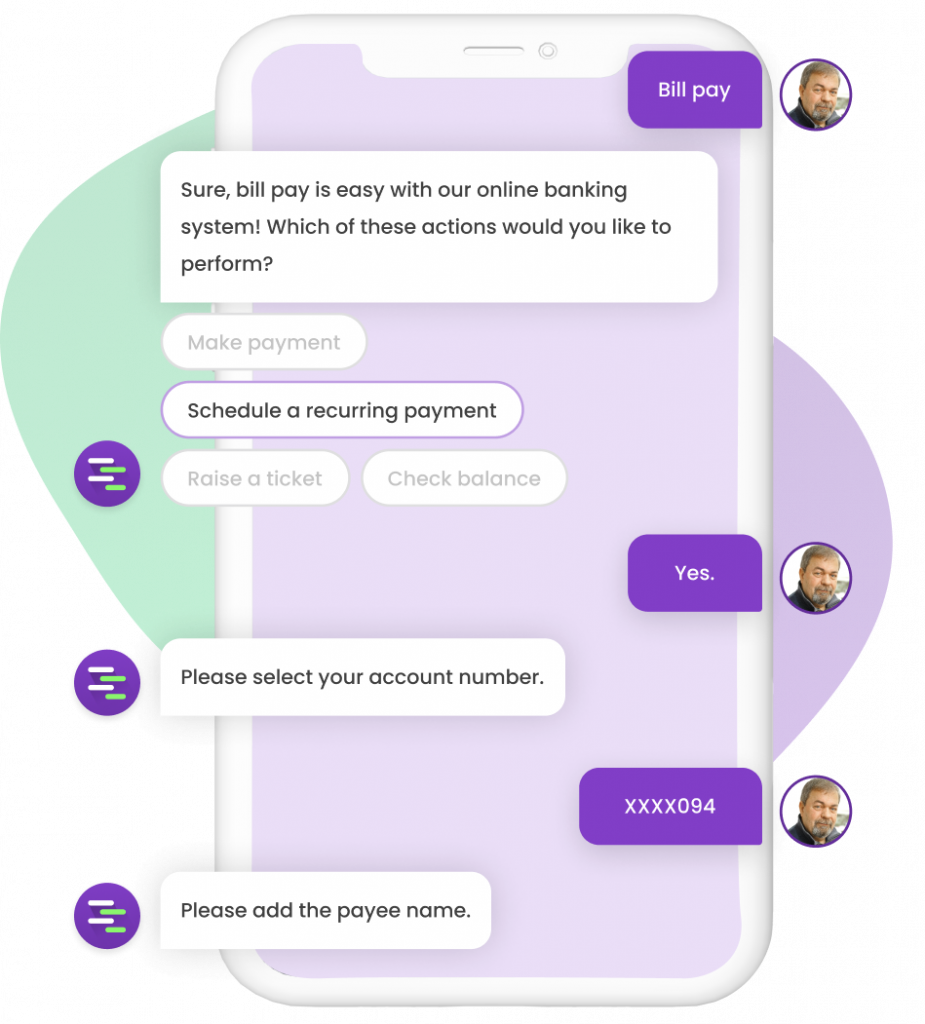

- Payment Collection: By sending reminders to customers about overdue payments and providing a convenient way for customers to make payments, AI Chatbots can automate payment collection. Moreover, AI Chatbots can integrate with payment processing platforms to allow customers to make payments via the Chatbot itself.

- Customer Support: AI Chatbots can improve the customer experience and automate customer support by handling queries and FAQs, offering personalized financial advice, and resolving invoice/payment issues.

3. AI Chatbots for financial analysis

- Trend Analysis: AI Chatbots can analyze financial data over time to help identify trends and patterns. For example, AI Chatbots can analyze revenue data to identify which products or services are most profitable, or analyze expense data to identify areas where costs can be reduced.

- Forecasting: AI Chatbots can use historical data to generate forecasts of future financial performance, helping businesses make informed and data-backed decisions.

- Scenario Modeling: AI Chatbots model different financial scenarios and help predict outcomes. For example, AI Chatbots can model the financial impact of expanding into a new market, or the impact of changing pricing strategies.

4. Account reconciliation

AI Chatbots compare financial records to ensure accuracy. For example, Xero’s Hey Xero Chatbot identifies discrepancies in financial records and flags them for review.

Account reconciliation involves comparing financial records to ensure they are accurate and complete. AI Chatbots can reconcile accounts automatically, identifying discrepancies and flagging them for review by accountants—hence saving time and ensuring accuracy.

5. Financial reporting

AI Chatbots can generate financial reports such as balance sheets, cash flow reports, and income statements. For example, Workday’s Workday Assistant generates these reports automatically, saving time for accountants.

Conclusion: The future of AI in Accounting

Automation in accounting is evolving rapidly. As technology evolves, accounting operations will keep becoming more efficient with greater cost savings—AI Chatbots are just the beginning of this technological revolution.

At Tars, we have been in the Conversational AI industry for over 8 years. With AI making strides in the finance landscape, we decided to go one step further with a hybrid approach, leveraging the strengths of both structured flows and Generative AI.

These hybrid AI Agents are backed by Tars Converse AI, taking on two main personas: Concierge AI and Advisor AI. Together, these custom-built agents can help automate the customer journey from start to end, by solving specific business problems and improving financial experiences.

To learn more about these agents, see Financial Concierge AI and Financial Advisor AI.

I am a content creator and marketer and a Conversational AI specialist. I enjoy crafting informative content that engages and resonates with my audience. In my spare time, I like to explore the interplay between interactive, visual, and textual storytelling, always aiming to bring new perspectives to my readers.

- What is automation of accounting processes?

- What are AI Chatbots and their applications in accounting?

- How AI Chatbots can be used for automation of accounting processes: Use cases

- 1. AI Chatbots for accounts payable

- 2. AI Chatbots for accounts receivable

- 3. AI Chatbots for financial analysis

- 4. Account reconciliation

- 5. Financial reporting

- Conclusion: The future of AI in Accounting

Build innovative AI Agents that deliver results

Get started for freeRecommended Reading: Check Out Our Favorite Blog Posts!

Madrid Murder Mystery: How Spanish Can Keep You Out of Jail?

How to create and use an AI based chatbot to answer FAQs – Comprehensive guide

Understanding chatbot machine learning – A comprehensive guide

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents