1. That chatbot asks the customer some question like the location of the building, who owns the building, when was it built, how many floors does it have, does it have a basement, the area of the building, are the sprinklers installed in all units, does the building a fire/burglar alarm, and is the building inside the city limits,

2. It asks the customer to share pictures of the building and the customer's current policy.

3. It asks the customer the expiration date of the current policy, if they made any claims in the last three years, if they can get the claim report from the insurance company, and rate the condition of the building.

4. It collects their contact info like email address and phone number.

5. The chatbot sends them an automated follow-up email with the information gathered from the chat conversation.

6. If the customer agrees to purchase an additional policy, the chatbot can be configured to automatically generate a quote for the new policy.

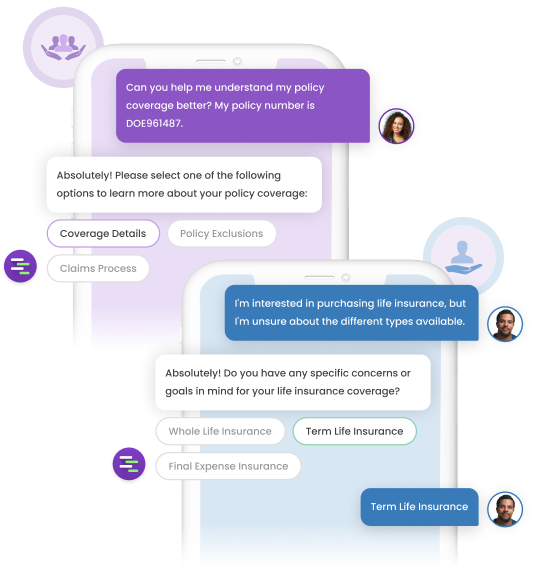

7. The chatbot also allows you to add more questions or options based on the answers given by the customer.

8. The chatbot saves the data collected during each conversation into a database. You can easily export the data from the database.

9. It can generate high-quality leads from the target audience.

10. It can save insurance agents time spent on phone calls.