1. The insurance underwriting chatbot asks if the customer would like to know more about the insurance company's services or get in touch with an expert.

2. The chatbot lists out the wide range of services that the company offers such as new business acquisitions, policy setup, policy admin, claims processing, etc.

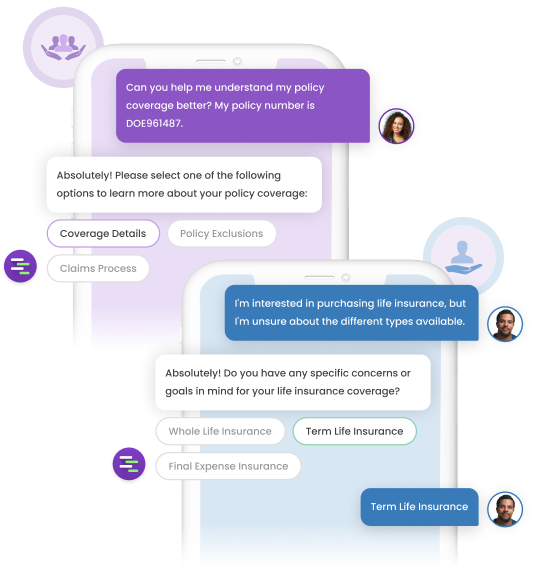

3. It then presents a list of various services under the category that the customer chooses.

4. It collects the customer's name, phone number, and email address to connect them with a representative.

5. The chatbot helps the customer by answering all his questions without any delay.

6. The chatbot has a great user interface which makes it easy to understand and maintains customer engagement.

7. It can easily replace a human agent.

8. The chatbot saves time and money for both parties.

9. The chatbot provides 24*7 support to its users.

10. It doesn't take time in making an underwriting decision.