How to build an AI Agent without coding: Decoding the AI Agent Builder Canvas

Learn to create a smart loan assistant that handles customer questions, captures leads, and manages complaints automatically

About this guide

This guide is based on a webinar led by Pratiksha, our customer success manager at Tars with over three years of experience in the field. What stood out was her practical approach to building AI Agents. As she put it during the session, “I build, eat, and drink AI Agents for a living.” This hands-on experience shows in how she breaks down complex concepts into simple, actionable steps.

In this detailed walkthrough, you’ll learn how to build AI Agents without any coding knowledge. Pratiksha demonstrated a real loan assistant that handles customer questions, captures interested leads, and manages complaints. The best part? Anyone can build something similar using drag-and-drop tools.

Why this matters for your business

Most businesses face the same challenge: customers ask the same questions repeatedly. Whether it’s about loan interest rates, eligibility criteria, or application processes, teams spend valuable time answering identical queries. An AI Agent can handle these conversations automatically while you focus on more complex tasks.

But here’s where it gets interesting. A well-built AI Agent doesn’t just answer questions. It can detect when someone wants to apply for a loan and automatically save their information. It can handle complaints and send organized emails to your support team. This level of automation used to require a development team and months of work.

What we built together

The loan assistant created in this walkthrough will do three main things:

Handle customer questions: When someone asks about interest rates or loan tenure, the Agent pulls answers from your knowledge base and responds immediately.

Capture potential customers: If someone shows interest in applying for a loan, the Agent collects their contact information and saves it to a Google Sheet automatically.

Process complaints: When customers have issues with their existing loans, the AI gathers details and sends a formatted email to your support team with a ticket number.

Getting started: Your first Agent

Start by signing up for a no-code AI platform. Most offer free trials that let you build and test your Agent without paying anything upfront. Once you log in, you’ll see templates for different industries, but this walkthrough builds from scratch to ensure you understand how everything works.

Click “Create AI Agent from scratch” and give it a name. In the webinar example, it was called “Loanie.” You’ll land on a blank canvas that looks intimidating at first, but it’s simpler than it appears.

Understanding the workspace

The platform organizes everything into three sections:

AI Agent Gambit: This is where you build your AI Agent’s workflow. Think of it as drawing a flowchart of how conversations should go.

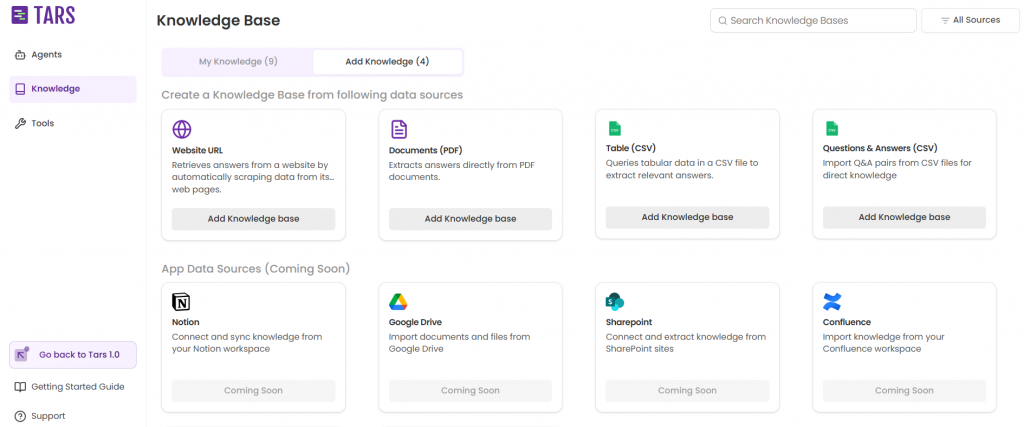

Knowledge: Your Agent needs information to answer questions accurately. This section stores all the documents, websites, or text that teach your AI Agent about your business.

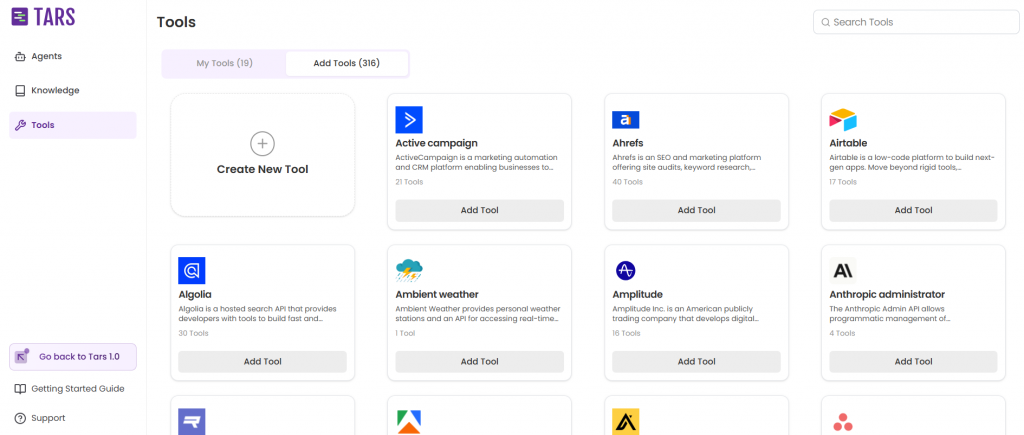

Tools: These are the actions your AI Agent can take, like updating spreadsheets or sending emails.

Building the brain of your AI Agent

Every AI Agent starts with a core AI Agent Gambit – the main brain that processes what customers say and decides how to respond. Here’s how to set it up:

Creating the welcome message

Your Agent needs to introduce itself. Keep it simple and friendly:

“Hi, I’m Loanie. Nice to meet you! How can I help you today?”

Writing the AI Agent prompt

This is where you tell your Agent how to behave. Think of it as giving instructions to a new employee. Be specific about what you want:

You are a friendly loan assistant. Keep your responses brief and break down large answers into small pieces. If users ask about loan tenure, interest rates, or general questions, always check the knowledge base first.

If you can’t find the answer in the provided information, say “I’m not sure about that” and don’t make up answers. Never discuss topics unrelated to loans and stay in character.

The key is being clear about boundaries. You don’t want your loan assistant giving cooking advice or discussing politics.

Teaching your Agent about loans

An Agent without knowledge is like hiring someone who knows nothing about your business. You need to feed it information about your loan products.

Adding a knowledge base

You have two options here. If your company has a website with loan information, you can simply add the URL and let the platform extract everything automatically. Otherwise, create a PDF with basic information like:

- Loan interest rates

- Maximum loan amounts

- Tenure options

- Eligibility criteria

- Required documents

Upload this PDF to the knowledge section and let the platform train your Agent on it. This process usually takes a few minutes.

Connecting knowledge to your Agent

Once the training is complete, go back to your Agent and add the knowledge tool. This connects your Agent’s brain to the information it needs to answer questions accurately.

Remember to click “Publish Agent” after making changes. Then test it by asking a few questions about interest rates or loan terms. Your Agent should now respond with accurate information from your knowledge base.

Capturing interested customers automatically

Here’s where things get interesting. Your Agent can detect when someone wants to apply for a loan and capture their information without any manual work.

Updating your Agent’s instructions

Add this section to your Agent prompt:

If a user shows interest in applying for a loan, collect their name, phone number or email, and preferred time for us to call them. Save this information to our Google Sheet automatically.

Setting up Google Sheets integration

Create a new Google Sheet with columns for Name, Phone, Email, and Preferred Time. Copy the sheet ID from the URL (the long string of characters in the middle).

In the Tools section of your platform, find the Google Sheets integration and connect it. You’ll need to give permission for the platform to access your Google account. Once connected, configure it to use your specific sheet ID.

Testing the lead capture

Now, when someone says “I want to apply for a loan,” your Agent will ask for their details and automatically save everything to your spreadsheet. You can watch this happen in real-time, which feels like magic the first time you see it.

Handling customer complaints

The third function of your Agent is processing complaints from existing customers. This requires a bit more setup but creates a professional support system.

Adding complaint handling to your prompt

Extend your Agent’s instructions with:

For existing customers with complaints, ask for their email address so we can create a support ticket. After collecting their email and complaint details, send a formatted email to our support team with all the information organized clearly.

Setting up automated emails

Connect the Gmail tool from the Tools section. This lets your Agent send emails from your business account. You’ll need to give permission for the platform to send emails on your behalf.

Configure the email template in your prompt itself.

The complaint workflow in action

When a customer says “I have a complaint,” your Agent will:

- Ask for their email address

- Request details about their complaint

- Categorize the issue (EMI problems, documentation issues, etc.)

- Generate a unique ticket ID

- Send a formatted email to your support team

- Confirm with the customer that their complaint was logged

This creates a professional support process that ensures no complaint gets lost or forgotten.

Making your Agent faster and smarter

Speed matters in customer service. Here are ways to optimize your Agent’s performance:

Keep prompts focused

Long, complicated instructions confuse AI models. Break complex tasks into smaller, specific directions. Instead of one giant paragraph, use numbered steps or bullet points.

Choose the right AI model

Different AI models have different strengths. GPT-4 is great for complex reasoning but might be slower. Claude excels at following instructions precisely. Test different models to find what works best for your use case.

Structure your knowledge base well

Organize your PDF or website content logically. Use clear headings and avoid duplicate information. The cleaner your knowledge base, the better your Agent’s responses.

Adding voice capabilities

Modern users expect multiple ways to interact with AI. Your Agent can handle voice conversations too.

The platform automatically includes speech-to-text functionality. Customers can click a microphone button and speak their questions instead of typing. The Agent converts speech to text, processes the question, and can even read the response aloud.

This is particularly helpful for loan applications where customers might be multitasking or prefer speaking over typing.

Monitoring and improving your Agent

Building the Agent is just the beginning. You need to track how it’s performing and make improvements based on real conversations.

Reviewing conversation logs

The platform stores every conversation your Agent has. Review these regularly to identify:

- Questions your Agent couldn’t answer (gaps in knowledge base)

- Common user frustrations or confusion points

- Successful lead captures and their patterns

- Complaint types and resolution times

Tracking key metrics

Monitor these numbers to measure success:

- Response accuracy: How often does your Agent give correct answers?

- Lead capture rate: What percentage of interested visitors provide their information?

- Customer satisfaction: Include rating requests at the end of conversations

- Time saved: Estimate how many hours of human work your Agent handles

Making iterative improvements

Based on your analysis, update your knowledge base with missing information, refine your prompts for clearer instructions, and add new capabilities as you identify needs.

Advanced features and integrations

Once your basic Agent is working well, consider these enhancements:

Multi-language support

AI models understand multiple languages automatically. If you serve customers who speak different languages, your Agent will detect their language and respond appropriately. You might need to translate your knowledge base content for the best results.

CRM integration

Instead of Google Sheets, connect directly to your CRM system like HubSpot, Salesforce, or Bitrix. This keeps all customer information in one place and triggers your existing follow-up processes.

Complex decision trees

Use the platform’s logic features to create different conversation paths based on customer type, loan amount, or other criteria. For example, business loan inquiries might follow different processes than personal loans.

Common challenges and solutions

Every AI Agent builder faces similar issues. Here’s how to handle them:

AI Agent gives wrong answers

This usually means your knowledge base needs work. Add more comprehensive information, remove contradictory content, and be more specific in your prompts about when to say “I don’t know.”

Slow response times

Review your Agent’s complexity. Too many tools or overly complicated prompts slow things down. Simplify where possible.

Integration problems

Double-check permissions for Google Sheets, Gmail, or other connected services. Make sure your sheet IDs and email addresses are correct. Test integrations individually before combining them.

Customers get confused

Review your conversation logs to see where confusion happens. Often, the Agent’s language is too technical or the conversation flow isn’t intuitive. Adjust your prompts to be more conversational and clear.

Scaling your AI Agent

As your Agent proves its value, you’ll want to expand its capabilities:

Multiple deployment channels

Beyond your website, deploy your Agent on social media platforms, mobile apps, or as a WhatsApp business bot. Most platforms support multiple deployment options.

Team collaboration

Larger businesses might need multiple people managing the Agent. Set up proper access controls and documentation so team members can make updates safely.

Performance monitoring

Implement more sophisticated analytics as your Agent handles more conversations. Track conversion rates, customer journey completion, and ROI measurements.

The business impact

Companies using AI Agents report significant improvements in customer service efficiency. Instead of hiring additional support staff as you grow, your Agent scales automatically. Customer questions get answered instantly, even outside business hours.

The lead capture functionality is particularly valuable. Instead of hoping interested visitors fill out contact forms, your Agent engages them in conversation and gathers information naturally. This typically improves conversion rates compared to static forms.

For complaint handling, the automated email system ensures consistency and prevents issues from being overlooked. Support teams receive organized information instead of scattered customer messages.

Getting started today

The technology for building sophisticated AI Agents is available now, and the learning curve is manageable for most business professionals. Start with a simple use case like FAQ handling, then gradually add more complex features as you become comfortable with the platform.

Most platforms offer free trials, so you can experiment without financial commitment. The time investment is minimal compared to traditional software development, and you can see results within hours rather than months.

The loan assistant example from Pratiksha’s webinar demonstrates what’s possible, but the same principles apply to any industry. Whether you’re in insurance, real estate, healthcare, or retail, you can build an Agent that handles your specific customer interactions.

The question isn’t whether AI Agents will become standard business tools – they already are. The question is whether you’ll build yours now or wait for competitors to gain the advantage.

A writer trying to make AI easy to understand.

- About this guide

- Why this matters for your business

- What we built together

- Getting started: Your first Agent

- Understanding the workspace

- Building the brain of your AI Agent

- Creating the welcome message

- Writing the AI Agent prompt

- Teaching your Agent about loans

- Adding a knowledge base

- Connecting knowledge to your Agent

- Capturing interested customers automatically

- Updating your Agent’s instructions

- Setting up Google Sheets integration

- Testing the lead capture

- Handling customer complaints

- Adding complaint handling to your prompt

- Setting up automated emails

- The complaint workflow in action

- Making your Agent faster and smarter

- Keep prompts focused

- Choose the right AI model

- Structure your knowledge base well

- Adding voice capabilities

- Monitoring and improving your Agent

- Reviewing conversation logs

- Tracking key metrics

- Making iterative improvements

- Advanced features and integrations

- Multi-language support

- CRM integration

- Complex decision trees

- Common challenges and solutions

- AI Agent gives wrong answers

- Slow response times

- Integration problems

- Customers get confused

- Scaling your AI Agent

- Multiple deployment channels

- Team collaboration

- Performance monitoring

- The business impact

- Getting started today

Build innovative AI Agents that deliver results

Get started for freeRecommended Reading: Check Out Our Favorite Blog Posts!

10 best alternatives to Intercom (Fin AI) for AI-powered customer service [2025]

Customer experience automation: The complete guide to CXA in 2025

How to measure customer experience: The complete guide for AI-powered support and growth

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents