How American Express used AI Agents to supercharge customer marketing campaigns?

Founded in 1850, American Express (Amex) is a multi-national behemoth, specializing in payment card services. Although few remember this today, the emphasis on ‘express‘ comes from its origin as an express mail venture in Buffalo, New York. Though far from being the Fortune 500 company it would eventually become, even in 1850, Amex was a pioneer in it’s freight-forwarding business — earning a reputation as a company people could trust while transporting some of their most valuable possessions.

When Amex introduced its first ‘charge card’ in 1958, it did so because customers needed the security of travellers’ cheques combined with the added flexibility of credit. The rest, as they say, is history.

Today, American Express is not only the world’s largest issuer of charge cards but also offers financial planning, corporate and credit cards, brokerage services, mutual funds, insurance, and other investment products.

How did a humble express mail venture become a financial giant? The story lies in its ability to constantly unlock new revenue opportunities by leveraging its customer trust & satisfaction.

Given this backstory, it should come as no surprise that Amex’s Indian subsidiary, American Express India has been carrying forward its pioneering legacy. Here’s how American Express India used Agentic workflow to supercharge their customer marketing campaigns ⤵️

The underrated importance of customer marketing

The word ‘marketing’ is often associated with the practice of attracting new customers with the help of ‘Mad-Men’ like skills. But in reality, marketing includes so much more!

One such domain of marketing that rarely gets the spotlight is: Customer Marketing. This refers to any marketing activity or campaigns directed at one’s existing customers. By focusing on elevating and leveraging current customers’ experiences, customer marketing can help drive 👇🏼

- Retention 🕛

- Growth 📈

Why would a business try to sell to its existing customer base when there’s an endless supply of fresh faces to convince? According to Marketing Metrics, businesses have a 60 to 70% chance of selling to an existing customer, while the probability of selling to a new prospect is only 5% to 20%. This increased probability makes customer marketing an extremely high RoI strategy that grows the bottom line by 👇🏼

- Reducing Churn Rate 🏃🏼♂️

- Increasing Customer Lifetime Value (CLV) 🎖️

For a business like American Express India, which sells a wide variety of financial products to the upper end of the Indian market, customer marketing is a ‘must-have’ in their toolbox. While mass-market brands often have a huge customer base with limited disposable incomes, Amex, due to its premium positioning strategy has built a solid customer base among the top earners in India. This naturally translates to a focus on customer marketing that includes convincing existing customers👇🏼

- To ‘upgrade’ their present services (for eg; from Gold Card to a Platinum Reserve Card)

- To buy fresh financial products (for eg; Amex Accidental Insurance)

But this is easier said than done. How exactly did Amex India go about achieving these customer marketing goals? Which channels did they choose? What challenges did they face?

To answer all of these, we need to examine ⤵️

Why Amex needed Agents to supercharge their SMS marketing campaigns?

Amex India‘s Customer Marketing relies heavily on SMS campaigns. As mobile phones have become ubiquitous today — running marketing SMS campaigns comes with the distinct advantage of reaching right inside your SMS inbox. As Amex had a substantial pool of clients who had opted in for SMS promotions, text messages seemed like an inexpensive and scalable strategy for sending “offers” related to upgrades & newly launched products, while also explaining their benefits.

Yet as we all know, SMS Marketing is not an unalloyed good in 2022. To paraphrase Shakespeare, “There are more things in heaven and Earth, Horatio; Than are dreamt of in your marketing meetings”

Years of spammy messaging practices have nearly killed the response rate for SMS campaigns. While SMS marketing can still boast of a 90%+ open rate (something that every SMS Marketing Blog touts), what is the point of that magical number if a majority of your customers simply delete your SMS within seconds of reading it. Without actual engagement, SMS marketing becomes a futile ritual.

This was a challenge that Amex India was well aware of. They knew they loved the advantages and ease of SMS marketing campaigns, but they also knew they needed a solution to increase engagement on their customer marketing SMSes. They needed a solution that 👇🏼

🎯 Could be easily integrated within their existing SMS campaigns.

🎯 Could be easily automated and scaled.

🎯 Could drive their customer engagement numbers up.

🎯 Could hold the attention of their customer base.

That’s how Tars Agents came into the picture.

How did Amex deploy Tars Agents?

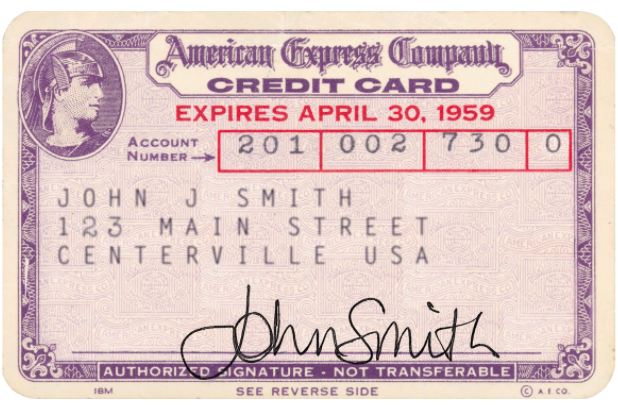

Tars partnered with Amex to build an extremely innovative solution in the form of Customer Marketing Agents, which could be easily added to their SMS Marketing campaigns. As each Agent was contained within an independent landing page, all users had to do was click on an SMS Link to engage in an automated, human-like conversation 👇🏼

Not only did the Agent fulfil the exact criteria that Amex wanted, but Tars Agents had the bonus of having a long history of incentivizing conversations for other enterprise-level businesses.

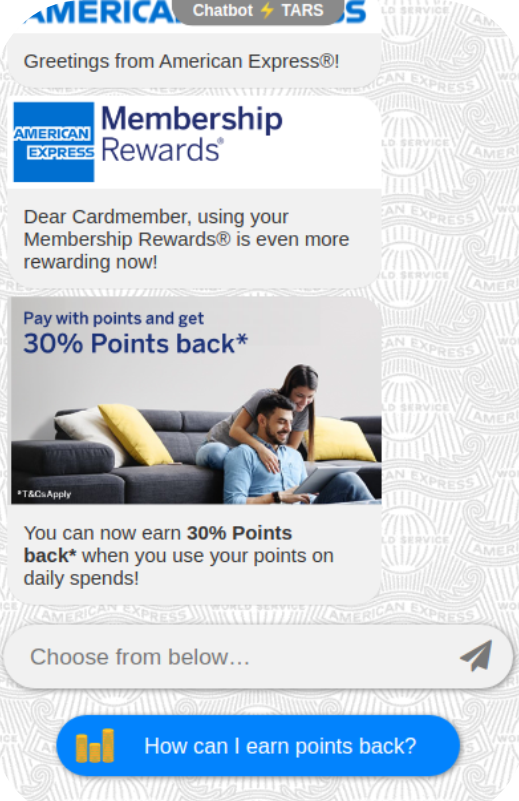

This meant that while initially our Agents were used for just customer marketing SMSes (for eg: card upgrades & reward point offers), Amex eventually ended up using us for other SMS campaigns too, for eg, application completion reminders and card delivery address collection 👇🏼

In fact, Amex India saw such value in Tars Agents that they even added us to their official website as one of the ‘Top Links’, titled ‘Chat To Explore Benefits’👇🏼

This is precisely why Agents are often referred to as an omnichannel solution.

What does a conversation with an Amex Agent look like?

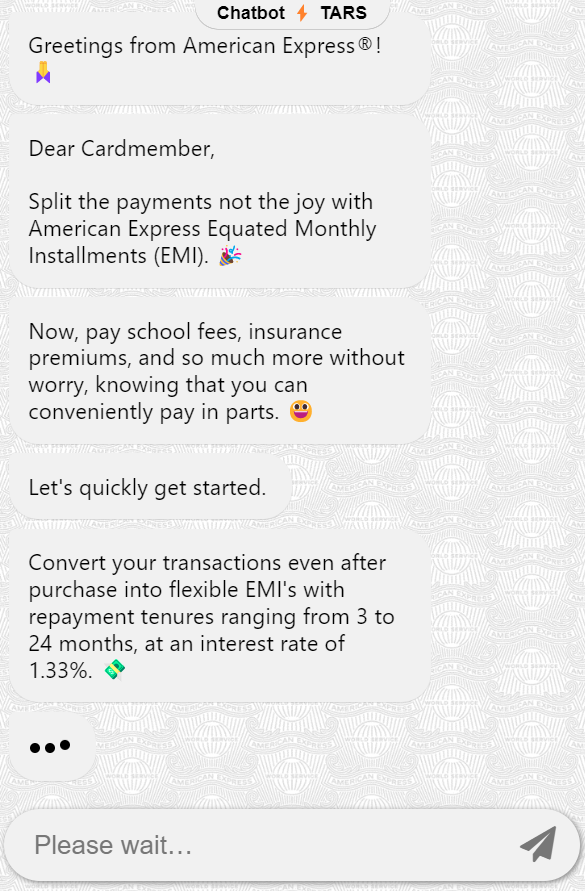

Step 1️⃣: Suppose you’re an American Express cardholder who has received an SMS notification for a new EMI scheme that has been launched by the company. You notice there is a link there prompting you to have a ‘conversation’. Intrigued as you are, you click on it, seeing something like this 👇🏼

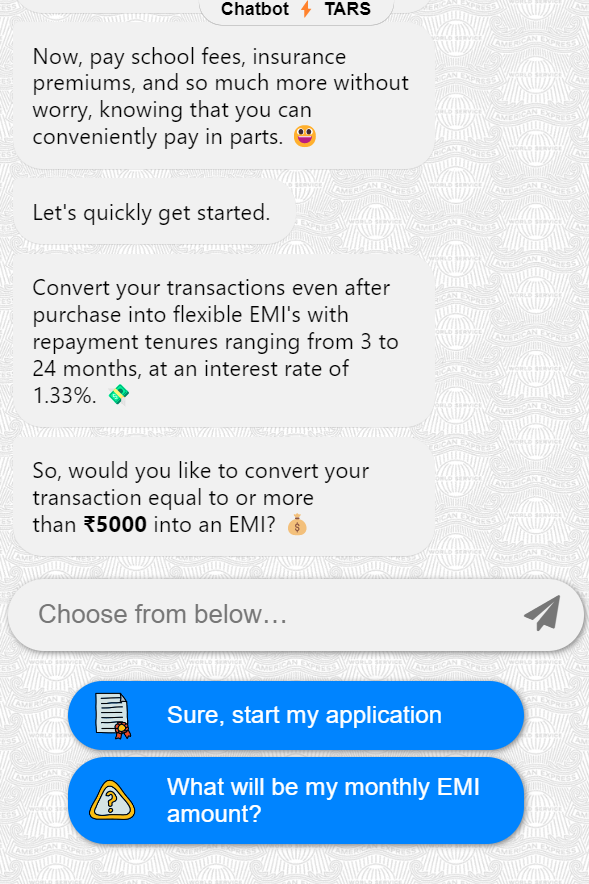

Step 2️⃣: A way to split your credit card transactions into flexible EMIs? Sounds amazing, but you’re a little apprehensive (as we all are) about the interest rates and what your actual repayment plan would look like. That’s when the Agent presents you with the following options 👇🏼

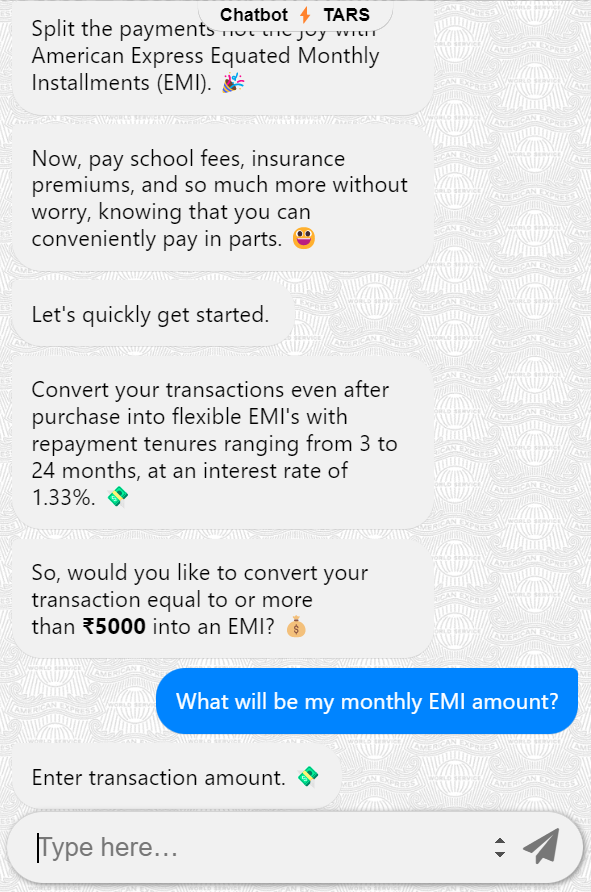

Step 3️⃣: As a financially responsible adult, of course, you want to know more about what you’re getting yourself into. So you click on the second option, which then prompts the Agent to enter the transaction amount on which you would like to calculate your EMI 👇🏼

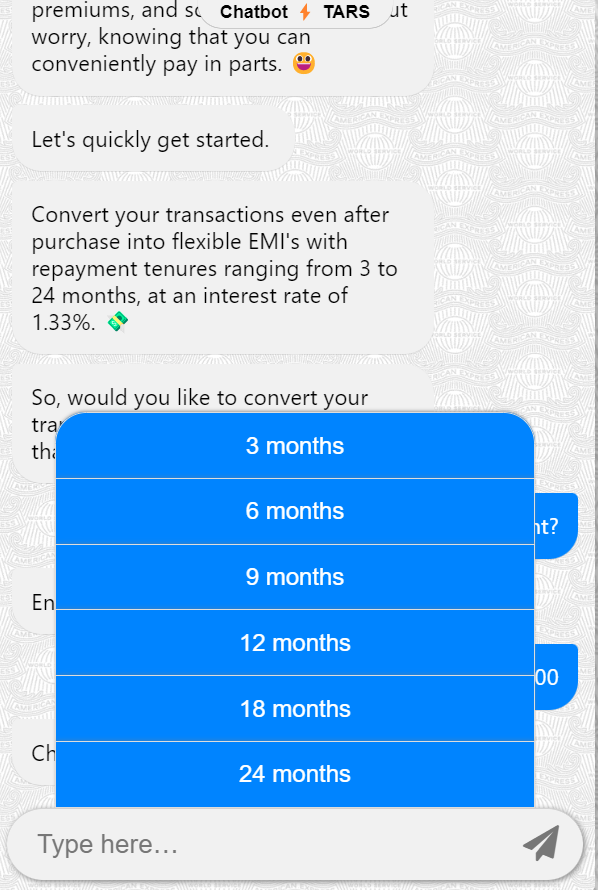

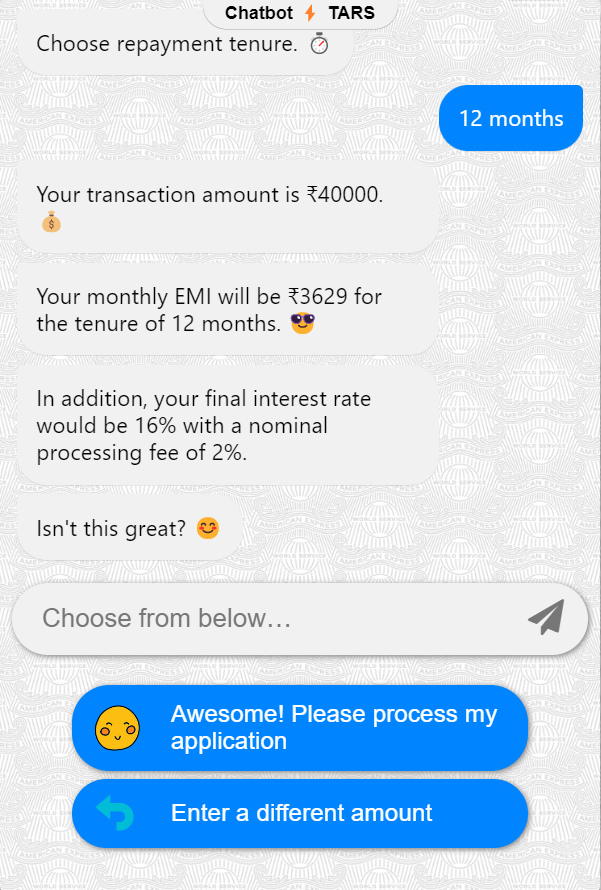

Step 4️⃣: Let’s say you enter ₹ 40,000 as the transaction amount and hit the send button. Once that’s done, the Agent will ask you to choose a repayment tenure 👇🏼

Step 5️⃣: Once you’ve chosen your repayment tenure, the Agent will automatically calculate your EMI to be ₹3629 every month, while also informing you about the interests and charges you’ll be paying. By now, you’re pretty convinced, certainly way more than you were when you saw a 50-character SMS.

So, of course, you choose to proceed with your application 👇🏼

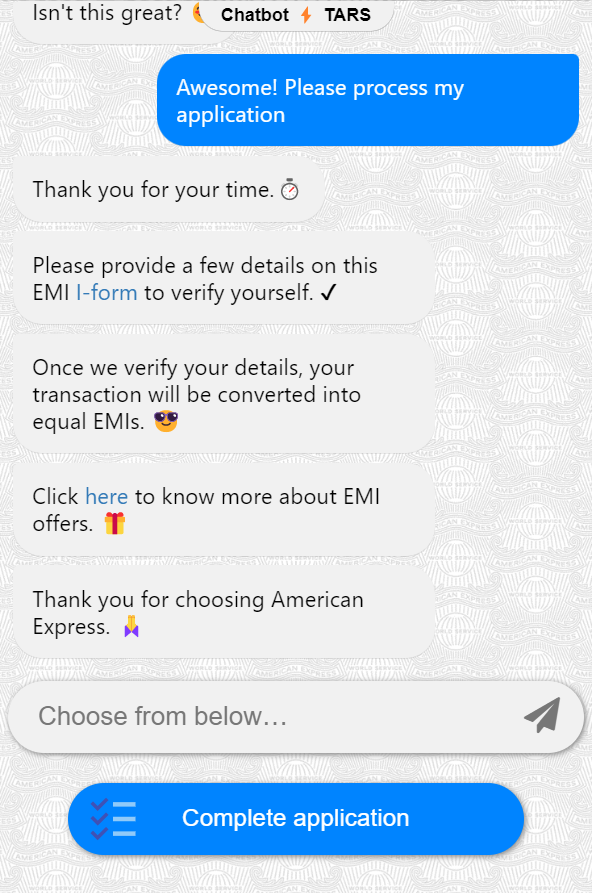

Step 6️⃣: Finally, the bot asks you to fill out a form to verify yourself, gives you a link to learn more about EMI offers, and then thanks you for choosing American Express 👇🏼

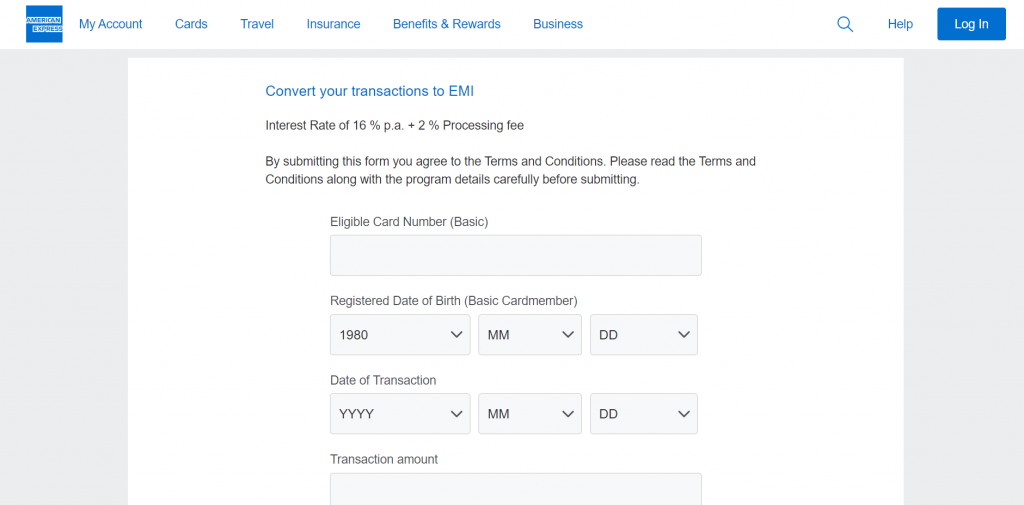

Step 7️⃣: The moment you click on the ‘Complete Application’ button, you are redirected to the EMI form on Amex’s page, which looks something like this 👇🏼

What was the impact of Amex’s Agent strategy?

The impact was tremendous! By deploying Tars Agents within SMS Marketing Campaigns & their official website, Amex was able to automate tens of thousands of conversations, with an incredible goal completion rate of 49.3%!

This meant that out 1 of every 2 customers who conversed with the Agents, ended up doing exactly what Amex India wanted! In other words, when the cute widget on the bottom of every one of our pages says “Ready to transform your customer experience“, we do mean it!

How to get started?

Book a demo with us today, and one of our in-house Agent experts will personally explain how you can use Agents to supercharge engagement at every stage of your customer journey!

Soham is a content marketer on the Tars team. When he's not writing kickass blog posts like the one you just read he's reading obscure articles from history's foremost anti-enlightenment thinkers and writing treatises to send to his 3 substack subscribers.

- The underrated importance of customer marketing

- Why Amex needed Agents to supercharge their SMS marketing campaigns?

- How did Amex deploy Tars Agents?

- What does a conversation with an Amex Agent look like?

- What was the impact of Amex’s Agent strategy?

- How to get started?

Build innovative AI Agents that deliver results

Get started for freeChosen by 800+ global brands across industries

Recommended Customer Success stories

AI in banking: Croí Laighean Credit Union’s journey to efficient customer support

45% reduction in support requests: VM Group’s success with Conversational AI Agents

How Tata Motors Finance generated 69,000+ leads with strategic CX automation?

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents