45% reduction in support requests: VM Group’s success with Conversational AI Agents

Client Overview: VM Group Limited

- Industry: Financial Services

- Region: Caribbean-based

- Business Model: Member-focused organization offering financial and non-financial services.

- Use Cases: Financial products and services, wealth management, investment, money transfer, pension management, and property services.

Challenge

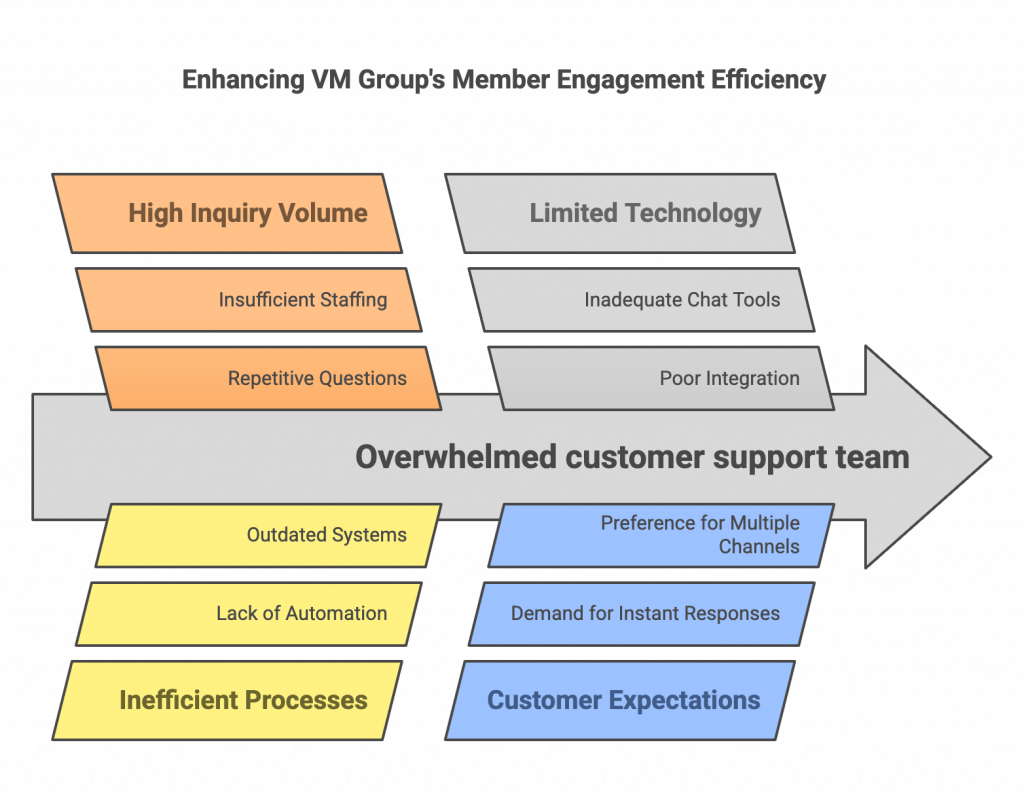

VM Group Limited faced a significant challenge in managing the high volume of calls and live chat requests directed to their member engagement team. This team, primarily composed of customer support Agents, was overwhelmed with repetitive inquiries, which affected their efficiency and the overall customer experience. Additionally, VM Group sought to provide its members with a more accessible and seamless way to interact with their banking services through web chat and WhatsApp.

Solution

To address these challenges, VM Group Limited partnered with Tars, a leader in Conversational AI solutions. Tars implemented an AI Agent specifically trained to handle repetitive customer questions and integrated it with VM Group’s existing knowledge base. This AI Agent was designed to deflect a significant portion of support inquiries, allowing human Agents to focus on more complex issues.

Furthermore, Tars enhanced the user experience by integrating money transfer services and a mortgage calculator into the conversational interface. This integration provided members with easy access to essential banking services directly through web chat and WhatsApp, aligning with VM Group’s goal of improving accessibility and user satisfaction.

Results

The implementation of Tars’ Conversational AI solution yielded impressive results for VM Group Limited:

- 45% Reduction in Support Requests: The AI Agent successfully deflected 45% of support requests, significantly reducing the workload on the member engagement team and improving response times for more complex inquiries.

- Enhanced User Experience: The integration of money transfer services and a mortgage calculator into the conversational interface provided members with a seamless and efficient way to access banking services, enhancing overall user satisfaction.

Key Takeaways

- Efficiency and Focus: By automating repetitive inquiries, VM Group’s support team could focus on more complex and value-added tasks, improving overall efficiency.

- Improved Accessibility: The integration of essential banking services into a conversational interface made it easier for members to access services, leading to higher satisfaction and engagement.

- Strategic Partnership: The collaboration with Tars demonstrated the value of leveraging advanced AI solutions to address customer service challenges and enhance user experience.

Ish is the co-founder at Tars. His day-to-day activities primarily involve making sure that the Tars tech team doesn’t burn the office to the ground. In the process, Ish has become the world champion at using a fire extinguisher and intends to participate in the World Fire Extinguisher championship next year.

Chosen by 800+ global brands across industries

Recommended Customer Success stories

AI in banking: Croí Laighean Credit Union’s journey to efficient customer support

How Tata Motors Finance generated 69,000+ leads with strategic CX automation?

How AI Automation Fixed The Engagement Crunch Of Prologis Learning Academy

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents