AI in banking: Croí Laighean Credit Union’s journey to efficient customer support

Croí Laighean Credit Union (CLCU) is a financial institution based in Ireland, serving over 45,000 individuals and businesses. They offer a wide range of financial services, including savings accounts, personal and business loans, and insurance products.

Ian Stewart, Head of Marketing at CLCU, identified that the customer service team was overwhelmed by repetitive queries, so he reached out to Tars to streamline these queries and better suggest best-suited loans to their users directly from their website.

‘Before’ implementing Tars:

Before the AI Agent implementation, CLCU’s call centre was handling over 34,000 calls annually. A large portion of these calls were from customers seeking basic information such as business hours, password login/resetting process, and loan enquiries, which were taking up valuable Agent time.

Metrics before implementation:

- Annual call volume: 34,000 calls/year

- Customer queries: Repetitive questions take up the live Agent’s major bandwidth from helping customers in loan applications.

- Lead capture: A Lengthy loan eligibility checking process that took up the majority time in nurturing hot leads.

Solution implemented:

Tars team implemented an AI Agent on the CLCU website to automate common queries and efficiently guide users through product recommendations for loans, savings, and mortgages.

Key Features implemented in the AI Agent:

- FAQ Support: Automated responses to FAQs, freeing up live Agents to handle complex tasks.

- Product Recommendations: Personalized recommendations for users seeking loans, savings accounts, and mortgages.

- Loan Eligibility Check: Basic level eligibility checks are in process to funnel down actual eligible leads for the sales team.

- Lead Capture: Collecting contact details for interested customers.

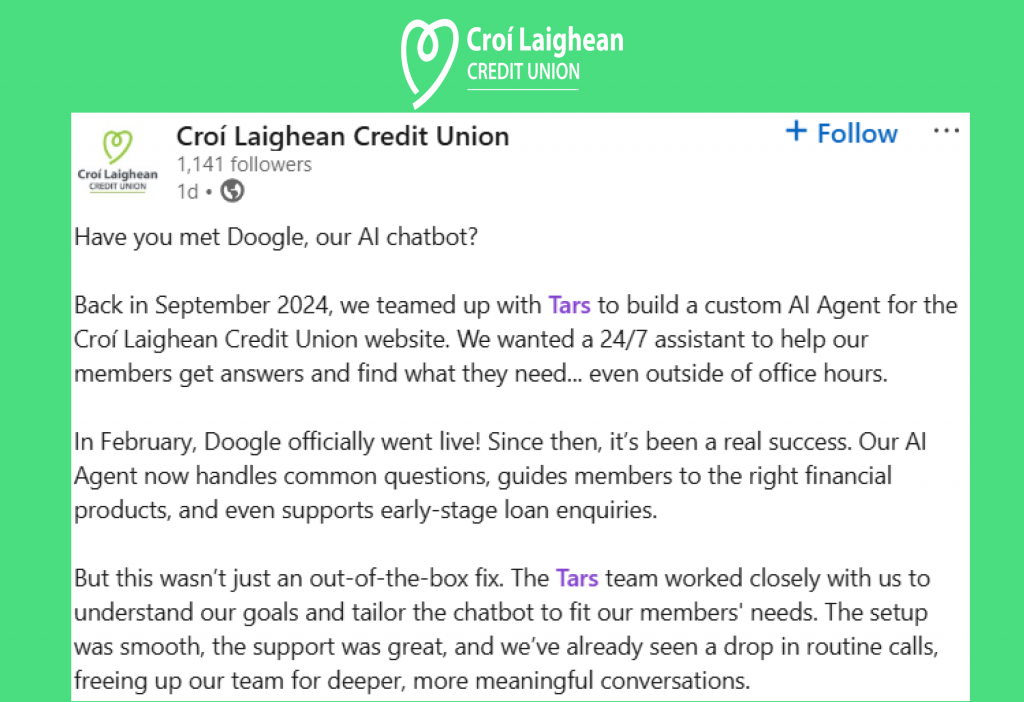

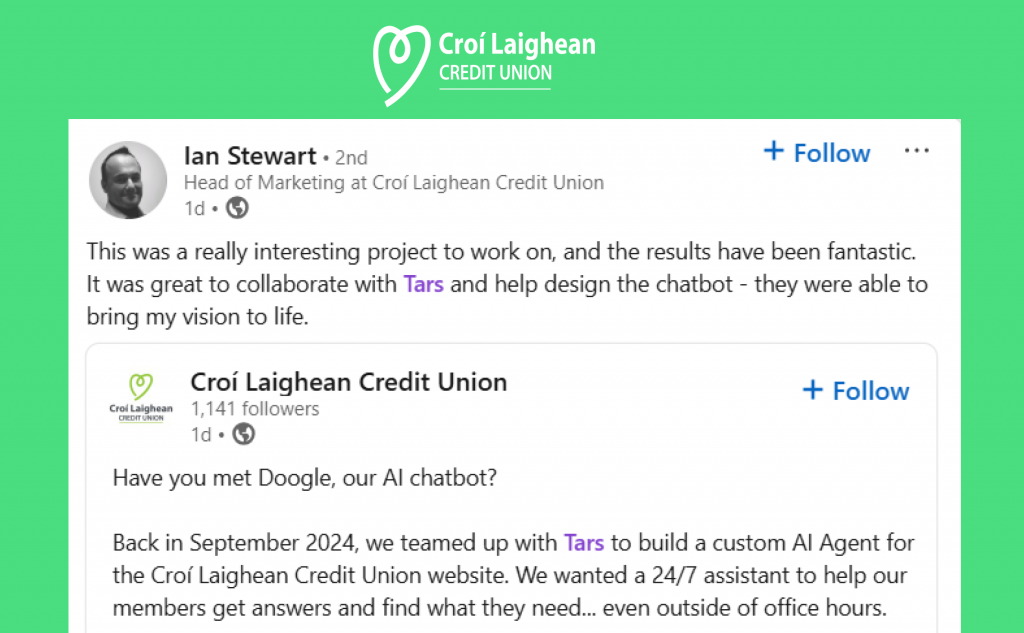

Here’s what CLCU had to say about Doogle:

After going live:

Post-implementation, CLCU experienced a significant reduction in both call volume and contact form submissions, reducing the burden on the call center team.

Metrics after implementation:

- Call volume reduction: 12% decrease in calls to the call center.

- Contact form reduction: 20% drop in contact form submissions, indicating the Agent’s effectiveness in handling informational queries.

- Customer engagement: Increased efficiency in handling loan, savings, and mortgage queries.

Key Milestones:

- Milestone 1: Successful, timely AI Agent deployment by the Tars Team.

- Milestone 2: Successful impact of the AI Agent from the first month of going live.

- Milestone 3: Post-launch monthly analysis of report trends, ongoing optimization, and additional adjustments based on customer interaction data, ensuring continued success and improvements in AI Agent’s performance.

My name is Vinit Agrawal and I am the Founder and CTO of Tars. I have been working on the Tars Chatbot Builder since 2015 and my core strength is in building software products with simple and functional user experiences focusing on bringing some core business results. My current role in the company is a mix of Product Manager, Engineering Manager and in Business & Marketing Strategy.

Chosen by 800+ global brands across industries

Recommended Customer Success stories

45% reduction in support requests: VM Group’s success with Conversational AI Agents

How Tata Motors Finance generated 69,000+ leads with strategic CX automation?

How AI Automation Fixed The Engagement Crunch Of Prologis Learning Academy

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents