How Search Media Agency Doubled Their Ad Conversion Rate Using A Chatbot

Key Takeaways

- Search Media Agency is a Singapore-based digital marketing agency that helps medium and small credit providers generate high quality leads through PPC campaigns and SEO.

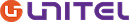

- They were using forms to capture leads on their clients’ landing pages and the conversion rate was low

- Their clients could not afford to increase AdSpend to offset this low conversion rate

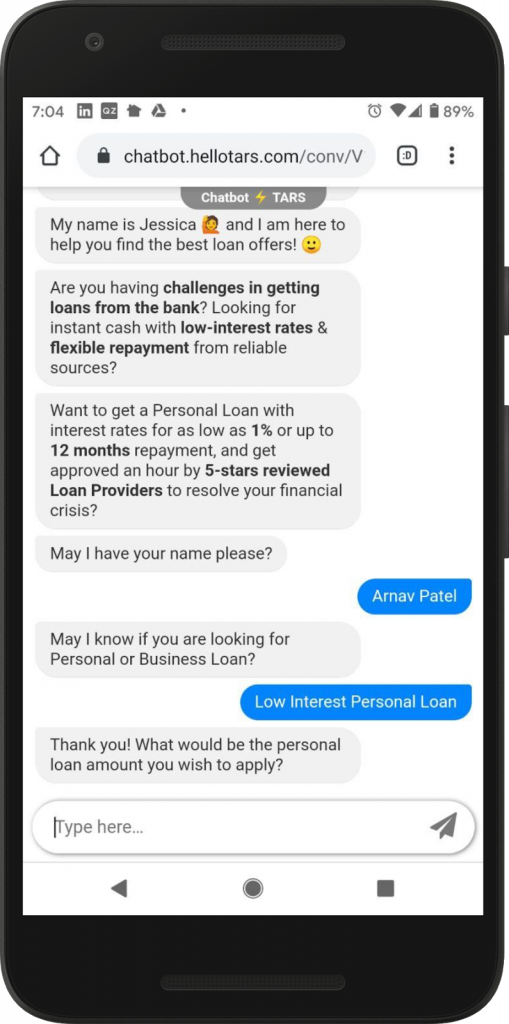

- They added a Tars chatbot to their landing pages and saw a 50% increase in their conversion rate

Search Media Agency is a Singapore-based digital marketing agency that helps medium and small credit providers generate high quality leads through PPC campaigns and SEO. Like pretty much every marketer on the planet, SMA captured leads on these campaigns through using forms and landing pages. This method worked but it was far from ideal. Conversion rates were not as high as they could be and as a result cost per lead was high. Using TARS chatbots, the agency was able to increase conversion rate 2x and drop cost per lead by a corresponding 50%. This is their story.

The Problem

As is the case with most financial services, the process of applying for credit is bureaucratic. From start to finish, customers are either negotiating/customizing the terms of their credit or filling out application forms.

This is especially a problem in the marketing process. At the end of the day, the success of any digital marketing campaign is going to be decided by the marketer’s ability to capture customer attention, and no matter how appealing your offerings are, forms are just plain boring. They’re unengaging, ugly, and absolutely no one like filling them out. The end result is that most credit marketing campaigns yield abysmally low conversion rates (in the sub-10% range).

Larger credit companies are able to get around this challenge by throwing money and manpower at the problem. Put simply, you can offset the low conversion rate by running more ad campaigns and investing more time and effort into SEO. But for mid-sized and small companies, like the ones that SMA serves, this isn’t an option.

With relatively small marketing budgets, it is almost impossible to spend enough money to compete with the big players in the market, and as a result, many of SMA’s customers were paying more money for less business.

The Solution

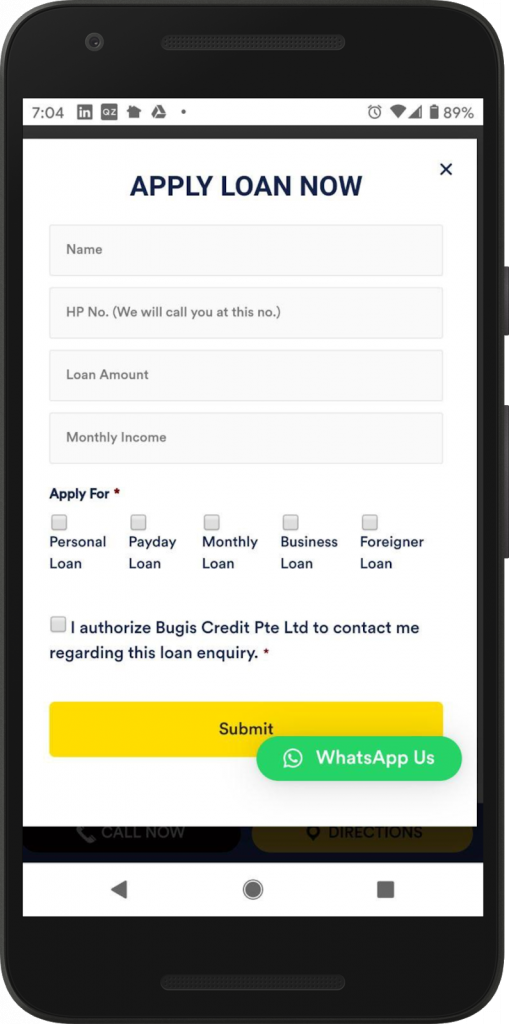

Recognizing the budget limitations of their clients, SMA decided to move away from forms and landing pages to a chatbot-based lead capture approach. Across 10 of their client’s pages, they deployed a TARS lead generation chatbot in the page widget.

These chatbots served the exact same purpose as their form counterparts: qualifying leads, and collecting contact details, but the way that they did this was vastly different than the forms. Details were collected by the bot through an exchange of text messages. While this might seem like a cosmetic change to the user experience but it actually had a profound impact on the results of SMA’s campaigns.

Unlike forms, chat is a back-and-forth process. This means that rather than loading all of the information on the page in one go (like in a form where all the fields load at once), chatbots ask for one detail at a time, waiting for the customer’s response before proceeding the interaction. The result of this type of interaction is that customers are greeted by new visual stimulation (in the form of message bubbles) every few seconds. This keeps them constantly engaged and reduces the likelihood of them dropping even though they are completing a relatively boring process.

In tangible numbers, SMA saw a 2x increase in conversion rate and correspondingly a 50% drop in cost per leads.

Conclusion

Financial services marketing is hard. The competition for customer attention invariably turns into a spending contest where the big players always win. Chatbots have the potential to change this situation. They help mid-sized and small financial services companies make more of their limited marketing budgets by converting more of the limited traffic that they do get into high-quality leads.

If you’re interested in replicating Search Media Agency’s results for your business, book a demo with us today.

Arnav is the Director of Content Marketing at Tars. He spends most days building bots, writing about conversational design and scrolling through Giphy’s trending section looking for the gifs that go into the Tars Newsletter.

Chosen by 800+ global brands across industries

Recommended Customer Success stories

AI in banking: Croí Laighean Credit Union’s journey to efficient customer support

45% reduction in support requests: VM Group’s success with Conversational AI Agents

How Tata Motors Finance generated 69,000+ leads with strategic CX automation?

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents