Buying Insurance is boring…but Chatbots can make it suck less

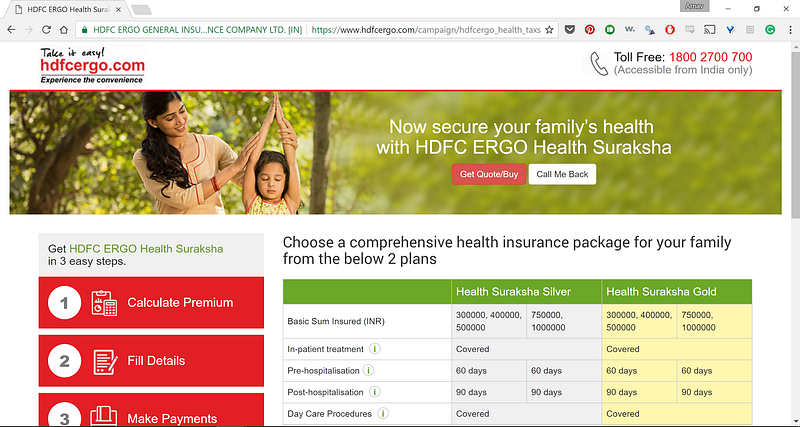

If you wanted to buy health insurance, how do you do it? I’d probably Google search “health insurance”, click on the first link (maybe skip the ads out of an irrational disdain) and reach a website that looks something like this:

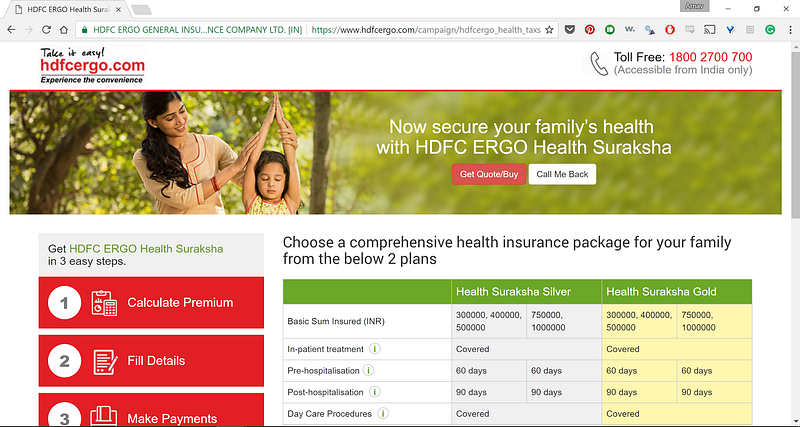

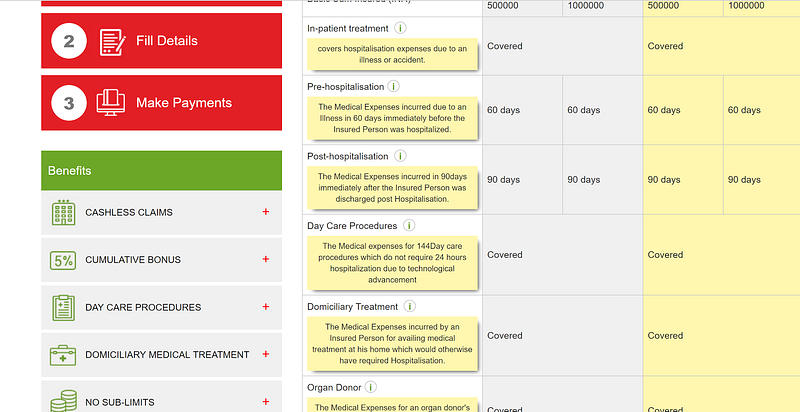

Once here, I find that I am woefully unprepared to carry on. What is basic sum insured? Pre-hospitalisation? Post-hospitalisation? Convalescence benefit? Ideally, I should have known what all these terms mean before I started searching for insurance, but I don’t.

Insurance providers like HDFC Ergo know this and provide more information. In the picture above, clicking on the little circled i’s next to each plan feature reveals further information. This is helpful, but only to a point. If I expand too many boxes the screen starts to look like a jumble of words.

At this point, I’d do what all people do best : procrastinate. I would return to facebook, youtube, snapchat or instagram and indulge myself in the endless stream of instant gratification I can get by simply picking up my phone or opening a new tab.

Suffice it to say that that websites can only take you so far. Too much text clutters the UI and makes the user experience unpleasant. Too little text, and the user is too uninformed to make a decision.

Consequently, insurance providers add the option for real human interaction in the form of instant call-back and live chats.

Through these mediums, an insurance broker could answer all the questions that a potential customer has and tell them exactly what they should or shouldn’t buy. The customer doesn’t need to do any digging or reading on their own.

However, this too is not a perfect solution.

Hiring real people is unscalable.

They need to be clothed, fed, and need days off.

If you are a large multi-national insurance company, you can throw money at these problems and minimise the inconvenience. If you are a smaller company though, this is not an option. You might as well say goodbye to those on the fence customers and focus on the informed ones.

But what if there was a solution.

What if you could have human interaction without the cost? Or inform users without human interaction?

This is the promise of chatbots.

Chatbots make conveying information easier than traditional mediums. They take a daunting, and impersonal process like reading up on insurance plans and turn it into a simple conversation.

Imagine if all of those uninformed leads could be funnelled into a familiar WhatsApp like interface where a piece of software living on Amazon’s servers personally answered all their queries as if it were a human. Chatbot interacts with potential clients as a real human would, to collect basic information about their level of knowledge and stage in the buying process. Thus, when a human does eventually get in touch with each potential client they don’t need to waste time figuring out what the client knows and can begin helping them immediately.

Here is an example of how Securenow, an Insurance Brokerage Company uses chatbots to help their customers — https://securenow.hellotars.com/conv/E1Tv56oIx

And this is how you can even showcase the best suited insurance plans over a chatbot — https://hellotars.com/convBot/demos/awesome_policy/

Chatbots are still in their early stages but it is hard not to see their game-changing potential in the insurance space. In an industry where information is important if not necessary to make purchasing decisions, chatbots have the potential to make the buying process easier for all the parties involved.

Like this story and my thoughts here? Click the applause below. It lets others see the story and helps me in reaching out to a lot more people 🙂

We are a bunch of nice people working to create something really cool and valuable for our customers. Interested in working with us? Drop me a line at ish[at]hellotars.com

Ish is the co-founder at Tars. His day-to-day activities primarily involve making sure that the Tars tech team doesn’t burn the office to the ground. In the process, Ish has become the world champion at using a fire extinguisher and intends to participate in the World Fire Extinguisher championship next year.

Recommended Reading: Check Out Our Favorite Blog Posts!

Top 10 Use Cases of Generative AI in Claims Management

Top 10 Digital transformation Trends in the Insurance Industry

What is InsurTech and How It Drives Digital Transformation in Insurance

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents