Top 10 Use Cases of Generative AI in Claims Management

Experts predict that by 2030, Generative AI will handle 50% of all claims management tasks.

This article explains how claims management workflows can improve with Generative AI.

Applying for a claim

An incident has caused a loss to the policyholder, say an accident or house fire.

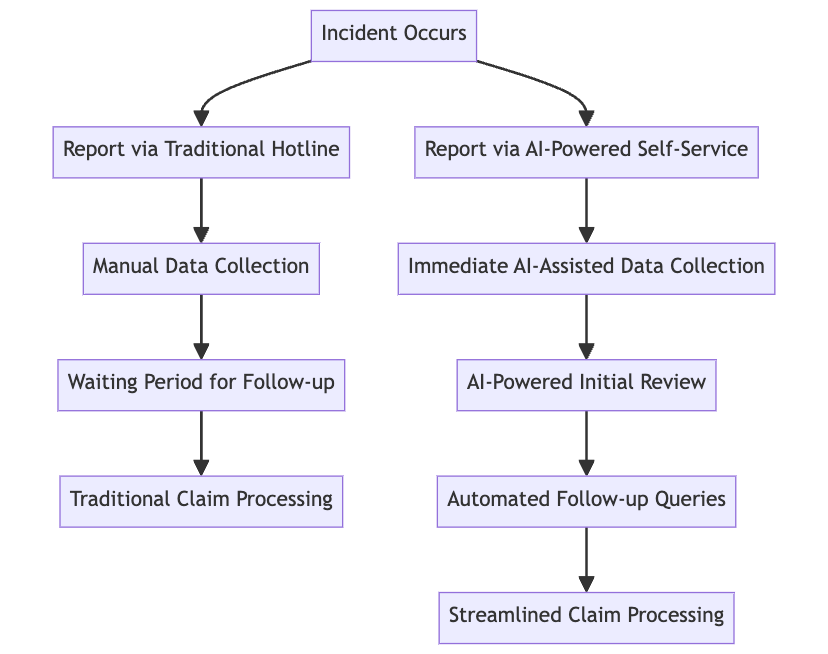

Here’s how it unfolds the old way :

- The policyholder calls the insurance company hotline to report the incident.

- An FNOL (First Notification Of Loss) call center agent takes the call.

- The policyholder shares the policy number and other basic details to the agent.

After adopting Generative AI :

- A self-service interface powered by Generative AI is the new hotline.

- There is no waiting period. Assistance is available 24/7. Once you share your details, the claim gets sent for initial review.

So what of the follow-up calls asking for more details?

You would share the details via email. This is the traditional way. Even then, it’d be days before you receive a reply from an agent.

Here’s where an AI agent comes in :

- With AI, policyholders can share extra details right after the incident. No more follow-ups required.

- Round-the-clock availability makes it easier for policyholders to report incidents anytime.

- Depending on the type of insurance and how complicated the incident is, policyholders can have their case sent to specialized agents.

- AI can guide policyholders through the data collection process. This is easier and faster than email exchanges.

- AI systems can request more details based on the initial information provided. There is no need for many follow-up calls or emails.

By automating these routine tasks, insurers can save money and use resources better.

Reviewing the Claim

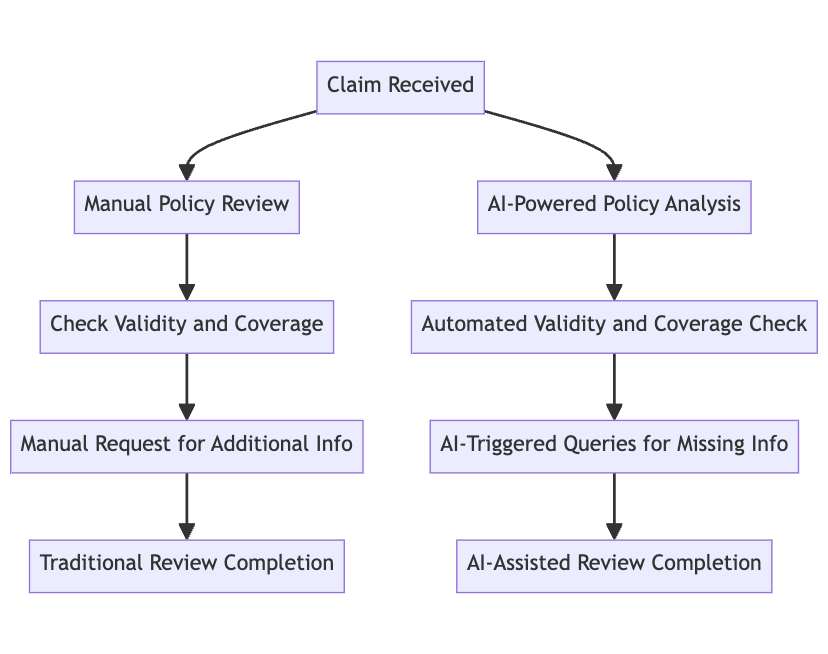

Reviewing a lot of claims is challenging. It consists of repetitive tasks like these:

- Examine specific terms and coverages of the policy under the claim.

- Determine whether the policy is valid and up-to-date.

- Check and confirm if the policy covers the losses

Here’s how AI can speed up the review process :

- AI can learn from customer service emails and send acknowledgment emails for claims. It can personalize the communication based on the claimant’s details and the nature of the claim.

- Modern AI models can analyze large data pools to identify patterns and anomalies. You could use the same to spot immediate red flags that might state issues with the claim. There are red flags that could state problems with the claim. These include inconsistencies, missing information, or discrepancies with policy coverage.

- For claims with missing information, AI systems could create triggers for the details. You can customize the query based on the claim and send it to the claimant using an email software.

- AI can extract key details from any document, PDFs, images, or free-form notes. Agents can use this to check deductibles and determine if the losses are covered.

- AI models can assess the severity of claims by analyzing how much is lost. Special cases can instantly be redirected for extensive review.

But initial reviews are a small part of the entire workflow. What of offline adjuster reviews?

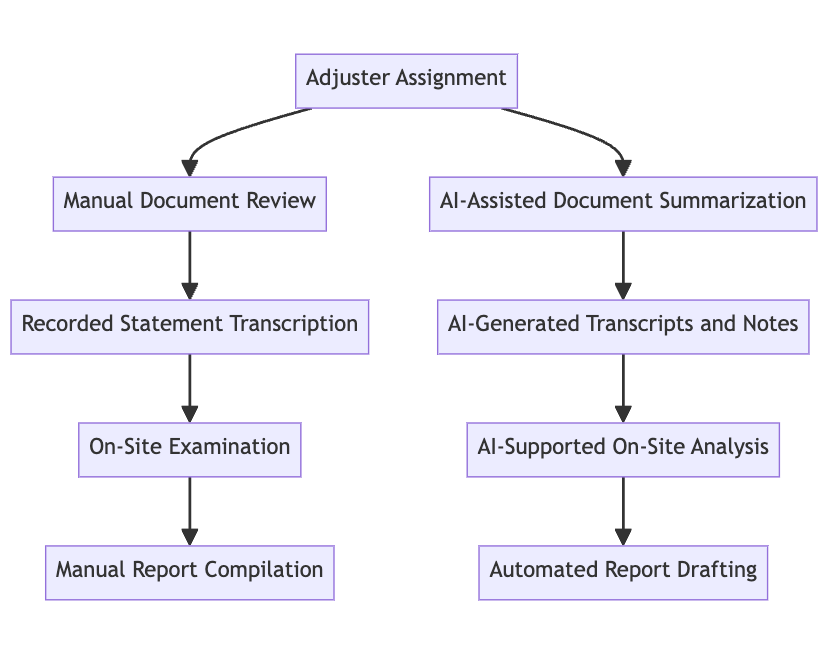

Assigning Adjustors

An adjuster’s role requires them to be an expert in people, math, and analytics.

Here’s how Generative AI lets them focus on their areas of expertise while it automates the rest –

- AI assists adjusters by summarizing and extracting important details from long pre-visit documents. This eliminates the need for manual sifting through the documents.

- Adjusters can use AI to turn recorded statements into written text. AI can also identify important points in conversations and generate short notes. These notes can highlight action items, dates, or specific claim details.

- Generative AI can also make contextual info from on-site photos. It can annotate these photos, labeling key elements of damage or interest. This can be particularly useful for later analysis and report compilation.

- AI can automate 20% of an adjustor’s workflow during an on-site examination. This includes reviewing records, evidence, and policies. This means a lesser workload and more space for the people’s part – Negotiating settlements.

So here are the top 10 use cases of generative AI in claims management –

| Claims Management – Various stages | Generative AI Use Cases |

| Applying for a Claim |

1. Automated First Notification of Loss (FNOL) Processing |

| Reviewing a Claim |

5. Automated Request for Additional Information |

| Assigning Adjustors |

9. Support for Adjusters in Pre-Visit Analysis |

And that’s a wrap!

How do I get started with Generative AI in Insurance?

Generative AI is more beneficial to insurers than policyholders.

It can enhance operational efficiency, reduce expenses, and optimize processes across various organizational levels. All while providing a smooth experience for all your customers.

Our expertise in prompt engineering, fine-tuning, and data alignment ensures seamless integration of AI into your processes. Don’t let the complexity of AI adoption slow you down.

Let our team guide you in harnessing AI’s potential to streamline operations, reduce costs, and improve efficiency.

Book your AI consultation session with Tars today – start your journey towards AI-driven excellence in claims management.

Recommended Reading: Check Out Our Favorite Blog Posts!

Top 10 Digital transformation Trends in the Insurance Industry

What is InsurTech and How It Drives Digital Transformation in Insurance

Top 10 Conversational AI Use Cases in Insurance

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents