How to improve customer experience in banking using AI Agents?

It’s Friday night, 11 PM. A treasury manager at a mid-sized company just finished preparing payroll for 200 employees—$250,000 ready to transfer. Tomorrow is payday.

The transaction fails.

She tries the bank’s chatbot. It gives her a toll-free number that only works during business hours. She’s stuck until Monday. The employees won’t get paid on time.

This isn’t a hypothetical scenario. It’s happening right now at banks across the country, despite billions spent on “digital transformation” and “AI-powered customer service.”

The gap between what banks promise and what customers actually experience has never been wider. And it’s costing the industry more than just frustrated customers—it’s costing real revenue.

Why customer experience matters more than ever in banking

All of the top 10 U.S. commercial banks have deployed chatbots. Consumer Financial Protection Bureau.

Also, a survey of ~149 banks (US + Canada + Europe) found that ~63% of the banks in the sample have chatbots.

The numbers tell a clear story. Banks that consistently optimize customer experience grow 3.2 times faster than their competitors. But here’s the harder truth: over 50% of consumers will switch to a competitor after just one bad interaction.

In the past year alone, 25% of customers switched banks. The reason? They wanted a better digital experience.

This shift isn’t about traditional banking services anymore. Customers aren’t comparing your bank to other banks—they’re comparing you to Netflix, Amazon, and Spotify. They expect the same speed, personalization, and convenience they get everywhere else.

When they don’t get it, they leave.

The three approaches banks use today (and why two of them fail)

Most banks rely on one of three approaches to handle customer interactions:

Traditional rule-based chatbots

You’ve seen these. They sit in the bottom right corner of banking websites, greeting visitors with pre-programmed responses. When customers ask real questions, these chatbots do one thing: provide a phone number or link to another page.

In our payroll scenario, the chatbot told the treasury manager to call during business hours. It couldn’t access her account, couldn’t see the transaction, and couldn’t help. It was essentially a fancy FAQ system that created more frustration than it solved.

The reality: These systems cost less to operate, but customer satisfaction is nearly zero for anything beyond simple questions.

Live human agents

This is still the backbone of banking customer service. Call centers, branch staff, relationship managers—real people trying to help real customers.

In the same payroll scenario, imagine our treasury manager reaches a human agent at 11 PM. The agent is helpful and understands the urgency. They look up her account, find the transaction, and identify the problem: the daily transfer limit of $200,000 was exceeded.

But here’s where it falls apart. The agent can’t increase the limit. That requires approval from a department manager who won’t be available until Monday. The problem is identified but not solved.

The reality: Human agents cost significantly more ($20-50 per interaction vs. $2-5 for automated systems), take longer to resolve issues, and still can’t always solve the problem. Resolution times range from hours to days. The experience is better than a basic chatbot, but the business outcome isn’t much different.

AI Agents (the promise)

Now imagine a third scenario with an AI Agent that has:

- Access to the customer’s account information

- Understanding of transaction patterns and fraud detection

- Authority to take specific actions within defined parameters

- Knowledge of bank policies and procedures

The treasury manager asks the same question at 11 PM. Within 20 seconds, the Agent:

- Identifies her account and pulls up recent transactions

- Locates the specific $250K transfer to the payroll service

- Recognizes it as legitimate based on her transaction history

- Explains that the daily limit was exceeded

- Offers to temporarily increase the limit and release the transfer

- Provides an option to permanently adjust the limit for future payrolls

The transaction completes in 15 minutes. The underlying issue is fixed for the future. Total cost: $2-5. Customer satisfaction: highest possible.

This is what AI Agents can do when they’re built correctly.

The gap between AI promise and reality

Here’s the uncomfortable truth: only 5% of companies that deployed AI Agents report measurable ROI.

A recent MIT study surveyed 150 companies across various industries. Out of all those businesses that invested in AI technology, 95% saw no positive return. The money spent on development, implementation, and maintenance didn’t translate to better customer experiences or cost savings.

Why? Because most organizations approached AI Agents the wrong way:

- They tried to automate everything at once instead of focusing on specific, high-impact use cases

- They deployed systems without proper testing or evaluation frameworks

- They didn’t integrate AI Agents with their existing tools and databases

- They expected out-of-the-box solutions to work in complex, regulated environments like banking

The 5% that succeeded did something different. They:

- Picked narrow, mission-critical use cases with clear ROI

- Started with human-AI collaboration before full automation

- Worked with specialized technology partners instead of building everything in-house

- Created realistic timelines and continuously improved based on real-world performance

Banking is a regulated, complex industry. The stakes are high. A mistake in financial services doesn’t just frustrate a customer—it can violate regulations, expose sensitive data, or cause real financial harm.

This is why building effective AI Agents for banking isn’t just about plugging in ChatGPT and calling it a day.

What actually works: Practical strategies to improve customer experience in banking

1. Start with customer support automation for specific scenarios

Don’t try to automate everything. Pick the most common, time-consuming customer issues that follow predictable patterns:

- Transaction failures and holds

- Account access problems

- Balance inquiries and transaction history

- Card activation and replacements

- Basic loan or account application questions

These scenarios happen hundreds or thousands of times per day. They’re expensive to handle manually, but the resolution steps are clear enough for an AI Agent to manage.

Start here. Build confidence. Then expand.

2. Give your AI Agents real access to real systems

The biggest limitation of traditional chatbots is that they can’t actually do anything. They can talk, but they can’t act.

For an AI Agent to improve customer experience, it needs:

- Read access to customer accounts, transaction history, and relevant documents

- Integration with your core banking system to check balances, verify transactions, and pull real-time data

- Action capabilities within defined parameters—like temporarily increasing limits, releasing held transactions, or initiating specific workflows

- Security protocols that protect sensitive information while still enabling the Agent to function

This is where most banks struggle. Legacy systems weren’t built for this kind of integration. But it’s also where the real value comes from. An AI Agent that can see account information and take appropriate action is fundamentally different from a chatbot that just surfaces links.

3. Build with a No-Code platform that reduces technical complexity

Here’s a reality check: your bank’s core business is finance, not software development.

Building AI Agents from scratch requires machine learning engineers, data scientists, integration specialists, and ongoing maintenance.

No-code AI Agent builders let your customer experience team, operations staff, and business analysts create and manage Agents without writing code. They can:

- Configure conversation flows based on their understanding of customer needs

- Connect to existing systems through pre-built integrations

- Test and refine Agent responses based on real interactions

- Deploy changes quickly without waiting for development cycles

This approach dramatically reduces time-to-value. Instead of spending 6-12 months building custom infrastructure, you can deploy a working Agent in weeks and improve it based on actual customer feedback.

4. Implement continuous testing and evaluation

Traditional software either works or it doesn’t. AI Agents are different—they’re probabilistic systems that can behave unpredictably.

You need a systematic way to:

- Monitor every conversation in real-time

- Identify when Agents provide incorrect information or take wrong actions

- Score interactions based on customer satisfaction and resolution quality

- Flag edge cases that need human review

- Continuously improve the Agent’s knowledge and capabilities

Without this layer, you’re flying blind. You might think your AI Agent is performing well while customers are actually getting frustrated by wrong answers or unhelpful responses.

The banks that succeed with AI Agents treat evaluation as a core feature, not an afterthought.

5. Create a hybrid model: AI Agents + human agents

The goal isn’t to replace all human agents—it’s to let AI Agents handle what they do well so humans can focus on what they do best.

Here’s what this looks like in practice:

AI Agents handle:

- Common questions with clear, documented answers

- Routine transactions that follow standard procedures

- Information lookup and account inquiries

- Initial triage and issue identification

- 24/7 coverage for time-sensitive requests

Human agents handle:

- Complex situations that require judgment

- Emotionally sensitive conversations

- Cases that fall outside standard procedures

- High-value customer relationships

- Escalations from AI Agents

This model gives you the efficiency of automation with the safety net of human expertise. It also creates a better experience for your human agents, who spend less time on repetitive tasks and more time solving interesting problems.

6. Focus on real business outcomes, not technology for its own sake

Every AI implementation should tie directly to business metrics:

- Reduced resolution time: Can customers get answers in minutes instead of hours?

- Lower cost per interaction: Are you spending less on routine customer service?

- Higher customer satisfaction: Are CSAT and NPS scores improving?

- Increased conversion rates: Are more prospects completing applications?

- Better retention: Are fewer customers switching to competitors?

If you can’t measure improvement in these areas, the technology isn’t working—no matter how sophisticated it seems.

Use cases where AI Agents make the biggest impact

Customer support and retention

The problem: Existing customers encounter issues—failed transactions, account access problems, questions about fees or services. Every unresolved issue is a potential churn risk.

How AI Agents help:

- Provide instant answers 24/7, even outside business hours

- Access customer history to give personalized responses

- Take immediate action to resolve simple issues

- Route complex cases to the right specialist with full context

- Follow up proactively when issues are resolved

Real impact: Customers get help when they need it. Resolution times drop from hours to minutes. Support costs decrease while satisfaction increases.

Customer acquisition and cross-selling

The problem: Prospects visit your website with questions about loans, credit cards, or new accounts. If they don’t get immediate, personalized answers, they leave. Your sales team never even knows they were there.

How AI Agents help:

- Answer product questions based on the prospect’s specific situation

- Pre-qualify leads by collecting necessary information naturally

- Provide personalized rate estimates using available data

- Guide prospects through application processes

- Schedule appointments with loan officers for complex cases

Real impact: More prospects convert because they get immediate, relevant help. Your sales team spends time on qualified leads instead of answering basic questions. The entire process moves faster.

The road ahead: Getting started with AI Agents

If you’re a banking executive or CX leader reading this, you’re probably thinking: “This sounds great, but where do we actually start?”

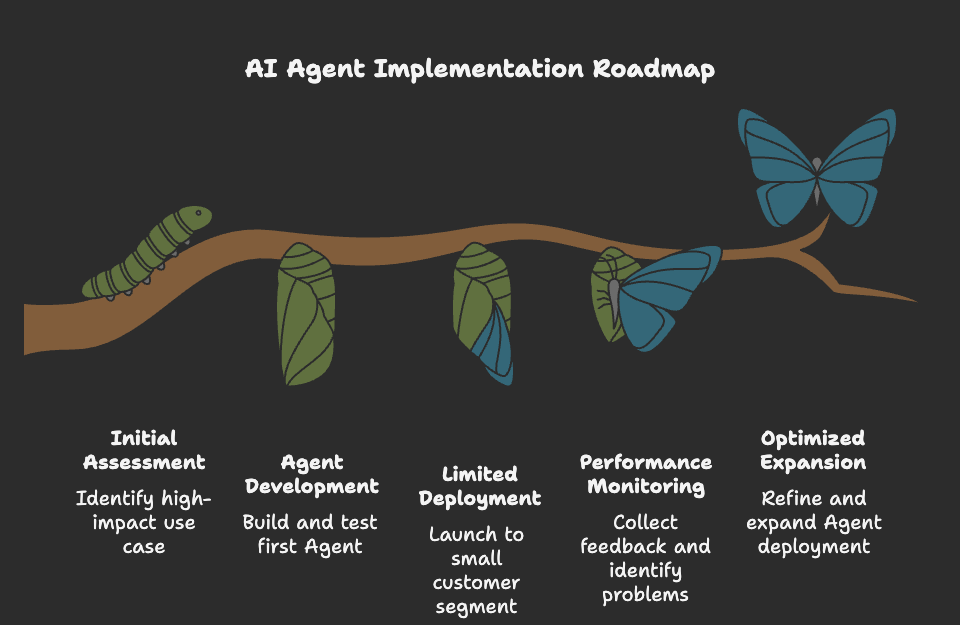

Here’s a practical roadmap:

Identify your highest-impact use case

- Review your customer service data to find the most common issues

- Calculate the current cost of handling these issues manually

- Pick one specific scenario to automate first

Build and test your first Agent

- Use a no-code platform to create the Agent

- Connect it to necessary systems and data sources

- Test extensively with internal users before customer deployment

Deploy with monitoring

- Launch to a small segment of customers

- Monitor every conversation

- Collect feedback and identify problems

Optimize and expand

- Refine the Agent based on real performance data

- Gradually expand to more customers

- Identify the next use case to tackle

This approach minimizes risk while building internal confidence. You learn what works in your specific environment before making major commitments.

The bottom line

Customer experience is now the primary competitive differentiator in banking. Traditional chatbots aren’t enough. Human agents alone are too expensive and too slow.

AI Agents, when built correctly, offer a genuine solution—combining the understanding of human conversation with the speed and scalability of automation.

But success requires the right approach: focused use cases, proper integration, continuous testing, and realistic expectations.

The banks that figure this out will grow faster, retain more customers, and operate more efficiently. The ones that don’t will keep losing customers to competitors who offer the seamless, personalized experiences that modern consumers expect.

The question isn’t whether to implement AI Agents. It’s whether you’ll be among the 5% that does it right—or the 95% that wastes money on technology that doesn’t deliver.

Ready to build AI Agents that actually improve customer experience? Tars is a no-code platform designed specifically for creating production-ready AI Agents in banking and financial services. With 10 years of customer experience expertise and a focus on real-world results, we help banks automate support and acquisition without the technical complexity.

A writer trying to make AI easy to understand.

- Why customer experience matters more than ever in banking

- The three approaches banks use today (and why two of them fail)

- Traditional rule-based chatbots

- Live human agents

- AI Agents (the promise)

- The gap between AI promise and reality

- What actually works: Practical strategies to improve customer experience in banking

- 1. Start with customer support automation for specific scenarios

- 2. Give your AI Agents real access to real systems

- 3. Build with a No-Code platform that reduces technical complexity

- 4. Implement continuous testing and evaluation

- 5. Create a hybrid model: AI Agents + human agents

- 6. Focus on real business outcomes, not technology for its own sake

- Use cases where AI Agents make the biggest impact

- Customer support and retention

- Customer acquisition and cross-selling

- The road ahead: Getting started with AI Agents

- The bottom line

Build innovative AI Agents that deliver results

Get started for freeRecommended Reading: Check Out Our Favorite Blog Posts!

[Webinar] The evolution of customer experience AI: From rigid chatbots to intelligent AI

Customer experience automation: The complete guide to CXA in 2025

How to measure customer experience: The complete guide for AI-powered support and growth

Our journey in a few numbers

With Tars you can build Conversational AI Agents that truly understand your needs and create intelligent conversations.

years in the conversational AI space

global brands have worked with us

customer conversations automated

countries with deployed AI Agents